| Zacks Company Profile for Komatsu Ltd. (KMTUY : OTC) |

|

|

| |

| • Company Description |

| Komatsu Ltd. is a major manufacturer of construction, mining and utility equipment and industrial machinery with operations all over the world. Approximately 91% of the company's revenue comes from the manufacture and sale of construction, mining and utility equipment, with about 6% of the total comes from industrial machinery and the rest from retail financing. Geographically, approximately 23% of Komatsu's 2021 revenues came from the North American region, with the rest coming from Latin America (15% of the total), Japan (12%), Asia (12%), Oceania (10%), Europe (9%), China (4%) and others. Komatsu's global headquarters is located in Tokyo, Japan.

Number of Employees: 66,697 |

|

|

| |

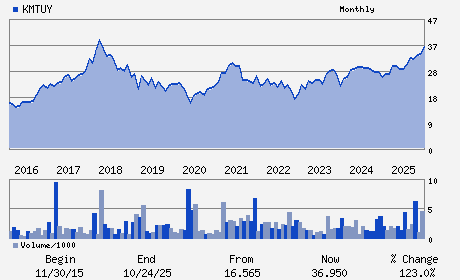

| • Price / Volume Information |

| Yesterday's Closing Price: $45.28 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 160,209 shares |

| Shares Outstanding: 930.34 (millions) |

| Market Capitalization: $42,125.82 (millions) |

| Beta: 0.97 |

| 52 Week High: $51.56 |

| 52 Week Low: $24.89 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.75% |

3.26% |

| 12 Week |

40.40% |

40.89% |

| Year To Date |

42.61% |

43.22% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Shiodome Building 1-2-20 Kaigan Minato-ku

-

Tokyo,M0 105-8316

JPN |

ph: 813-6849-9700

fax: 813-3586-0374 |

None |

http://www.komatsu.jp/ja |

|

|

| |

| • General Corporate Information |

Officers

Takuya Imayoshi - President and Representative Director Chief Execut

Hiroyuki Ogawa - Chairman of the Board Director

Takeshi Horikoshi - Representative Director Senior Executive Officer C

Mitsuko Yokomoto - Director

Taisuke Kusaba - Director

|

|

Peer Information

Komatsu Ltd. (ASTE)

Komatsu Ltd. (EMAT)

Komatsu Ltd. (MTW)

Komatsu Ltd. (KMTUY)

Komatsu Ltd. (JOY)

Komatsu Ltd. (CMI.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-CONST/MNG

Sector: Industrial Products

CUSIP: 500458401

SIC: 3531

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 930.34

Most Recent Split Date: 2.00 (4.00:1)

Beta: 0.97

Market Capitalization: $42,125.82 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.06% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.93 |

| Current Fiscal Year EPS Consensus Estimate: $2.28 |

Payout Ratio: 0.32 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 2.67% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |