| Zacks Company Profile for Kandi Technologies Group, Inc. (KNDI : NSDQ) |

|

|

| |

| • Company Description |

| KANDI TECHNOLOGIES, CORP. is a PRC (China)-based vehicle machinery producer, concentrating on three areas of small vehicle production: go-karts, special purpose vehicles and casual purpose vehicles. At present, it is among the leading producers of go-karts in the world, with an estimated 15% share of China's global export market and a goal of doubling this share, in large part by becoming the leading producer of this increasingly popular recreational product in China. Focusing on the country's rapid economic development, the Company also sees an increasing need for transportation vehicles for specific purposes, in particular, mini-size pesticide spraying vehicles and mini-service vehicles. Additionally, the Company produces a wide and growing range of All Terrain Vehicles which it believes represent the highest quality vehicles of this type in China, aimed at the export market as well as the rapidly growing market in the PRC.

Number of Employees: 739 |

|

|

| |

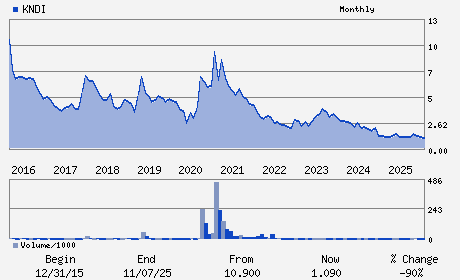

| • Price / Volume Information |

| Yesterday's Closing Price: $1.01 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 104,430 shares |

| Shares Outstanding: 85.48 (millions) |

| Market Capitalization: $86.76 (millions) |

| Beta: 0.55 |

| 52 Week High: $1.77 |

| 52 Week Low: $0.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.33% |

-2.00% |

| 12 Week |

7.97% |

7.42% |

| Year To Date |

28.89% |

28.21% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Feng Chen - President and Chief Executive Officer

Dong Xueqin - Chairman of the Board

Jehn Ming Lim - Chief Financial Officer

Chen Liming - Director

Lin Yi - Director

|

|

Peer Information

Kandi Technologies Group, Inc. (BAJAY)

Kandi Technologies Group, Inc. (ESCA)

Kandi Technologies Group, Inc. (GOYL)

Kandi Technologies Group, Inc. (FTSP)

Kandi Technologies Group, Inc. (KTO)

Kandi Technologies Group, Inc. (BOLL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC PRD

Sector: Consumer Discretionary

CUSIP: G5214E103

SIC: 3714

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/24

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 85.48

Most Recent Split Date: (:1)

Beta: 0.55

Market Capitalization: $86.76 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |