| Zacks Company Profile for Kronos Worldwide Inc (KRO : NYSE) |

|

|

| |

| • Company Description |

| Kronos Worldwide, Inc. is a leading producer and marketer of TiO2, a white pigment for providing whiteness, brightness and opacity. TiO2 is a key component of applications such as coatings, plastics and paper, inks, food and cosmetics and is the biggest commercially used whitening pigment. The company provides its customers a vast portfolio of products that include more than 40 different TiO2 pigment grades that offer a number of performance properties to address customers' specific needs. Its major customers include domestic and international paint, plastics, decorative laminate and paper makers. For coatings, TiO2 is used in industrial coatings and coatings for commercial and residential interiors and exteriors, automobiles, aircraft, machines, appliances and traffic paint. The company's TiO2 is also used in the production of several types of paper including laminate paper and filled paper. Kronos along with its distributors and agents market and provide technical services for its products.

Number of Employees: 2,524 |

|

|

| |

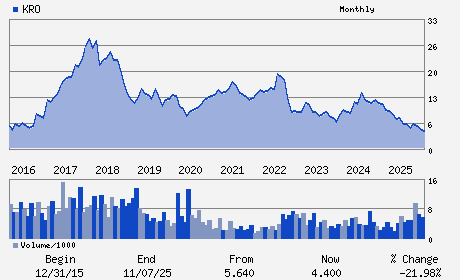

| • Price / Volume Information |

| Yesterday's Closing Price: $5.81 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 266,710 shares |

| Shares Outstanding: 115.05 (millions) |

| Market Capitalization: $668.46 (millions) |

| Beta: 1.12 |

| 52 Week High: $8.93 |

| 52 Week Low: $4.08 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.67% |

11.63% |

| 12 Week |

22.83% |

22.68% |

| Year To Date |

31.45% |

30.81% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

5430 LBJ FREEWAY SUITE 1700

-

DALLAS,TX 75240

USA |

ph: 972-233-1700

fax: 972-448-1445 |

None |

http://www.kronostio2.com |

|

|

| |

| • General Corporate Information |

Officers

James M. Buch - Chief Executive Officer and President

Loretta J. Feehan - Chair of the Board

Michael S. Simmons - Vice Chairman of the Board

Tim C. Hafer - Executive Vice President and Chief Financial Offic

John E. Harper - Director

|

|

Peer Information

Kronos Worldwide Inc (ENFY)

Kronos Worldwide Inc (EMLIF)

Kronos Worldwide Inc (GPLB)

Kronos Worldwide Inc (BCPUQ)

Kronos Worldwide Inc (CYT.)

Kronos Worldwide Inc (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 50105F105

SIC: 2810

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/09/26

|

|

Share - Related Items

Shares Outstanding: 115.05

Most Recent Split Date: 5.00 (2.00:1)

Beta: 1.12

Market Capitalization: $668.46 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.44% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.20 |

| Current Fiscal Year EPS Consensus Estimate: $0.21 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/09/26 |

|

|

|

| |