| Zacks Company Profile for Karat Packaging Inc. (KRT : NSDQ) |

|

|

| |

| • Company Description |

| Karat Packaging Inc. is a specialty distributor and manufacturer of disposable foodservice products and related items. Its products include food and take-out containers, bags, tableware, cups, lids, cutlery, straws, specialty beverage ingredients, equipment, gloves and other products. The company also offers customized solutions, including new product development and design, printing and logistics services. Karat Packaging Inc. is based in CHINO, Calif.

Number of Employees: 721 |

|

|

| |

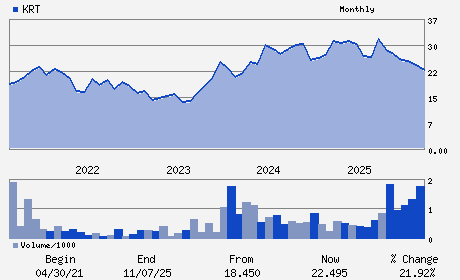

| • Price / Volume Information |

| Yesterday's Closing Price: $24.65 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 61,021 shares |

| Shares Outstanding: 20.10 (millions) |

| Market Capitalization: $495.45 (millions) |

| Beta: 1.09 |

| 52 Week High: $32.68 |

| 52 Week Low: $20.61 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.74% |

1.62% |

| 12 Week |

12.25% |

12.11% |

| Year To Date |

9.22% |

8.69% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Alan Yu - Chief Executive Officer

Jian Guo - Chief Financial Officer and Director

Eric Chen - Director

Paul Chen - Director

Eve Yen - Director

|

|

Peer Information

Karat Packaging Inc. (AEPI)

Karat Packaging Inc. (WFF)

Karat Packaging Inc. (AMCR)

Karat Packaging Inc. (AMCRY)

Karat Packaging Inc. (GEF)

Karat Packaging Inc. (DSGR.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONTNRS-PPR/PLS

Sector: Industrial Products

CUSIP: 48563L101

SIC: 3089

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 20.10

Most Recent Split Date: (:1)

Beta: 1.09

Market Capitalization: $495.45 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.30% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.24 |

Indicated Annual Dividend: $1.80 |

| Current Fiscal Year EPS Consensus Estimate: $1.54 |

Payout Ratio: 1.18 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.72 |

| Estmated Long-Term EPS Growth Rate: 11.22% |

Last Dividend Paid: 02/20/2026 - $0.45 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |