| Zacks Company Profile for KT Corporation (KT : NYSE) |

|

|

| |

| • Company Description |

| KT Corporation provides telecommunication services. Its services include mobile telecommunications services, telephone services, fixed-line and VoIP telephone services. The Company also provides interconnection services to other telecommunications companies, broadband Internet access services and other Internet-related services. It also offers information technology and network services, including consulting, designing, building, and maintaining of systems and communication networks. KT Corporation, formerly known as Korea Telecom Corp., is headquartered in Sungnam, South Korea.

Number of Employees: 16,927 |

|

|

| |

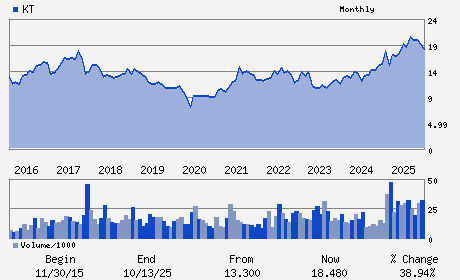

| • Price / Volume Information |

| Yesterday's Closing Price: $18.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,694,557 shares |

| Shares Outstanding: 515.72 (millions) |

| Market Capitalization: $9,546.01 (millions) |

| Beta: 0.67 |

| 52 Week High: $21.61 |

| 52 Week Low: $15.49 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.98% |

-0.43% |

| 12 Week |

-7.36% |

-10.97% |

| Year To Date |

19.26% |

1.65% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

33 Jong-ro 3-Gil Jongno-gu

-

Seoul,M5 03155

KOR |

ph: 82-70-4193-4036

fax: 82-3-1727-0949 |

None |

http://www.kt.com |

|

|

| |

| • General Corporate Information |

Officers

Young Shub Kim - Chief Executive Officer

Chang-Yong Ahn - Senior Executive Vice President

Seung-Phil Oh - Senior Executive Vice President

Young-Bok Lee - Senior Executive Vice President

Hyeon-Seuk Lee - Senior Executive Vice President

|

|

Peer Information

KT Corporation (ORANY)

KT Corporation (QBCRF)

KT Corporation (VOD)

KT Corporation (TIMB)

KT Corporation (PHI)

KT Corporation (IRIDQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Wireless Non-US

Sector: Computer and Technology

CUSIP: 48268K101

SIC: 4813

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/09/26

|

|

Share - Related Items

Shares Outstanding: 515.72

Most Recent Split Date: (:1)

Beta: 0.67

Market Capitalization: $9,546.01 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.56% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.66 |

| Current Fiscal Year EPS Consensus Estimate: $2.58 |

Payout Ratio: 0.35 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 50.91% |

Last Dividend Paid: 11/05/2025 - $0.17 |

| Next EPS Report Date: 03/09/26 |

|

|

|

| |