| Zacks Company Profile for KULR Technology Group, Inc. (KULR : AMEX) |

|

|

| |

| • Company Description |

| KULR Technology Group Inc. develops and commercializes thermal management technologies for electronics, batteries and other components applications principally in the United States, through its subsidiary, KULR Technology Corporation. KULR Technology Group Inc. is based in Campbell, California.

Number of Employees: 52 |

|

|

| |

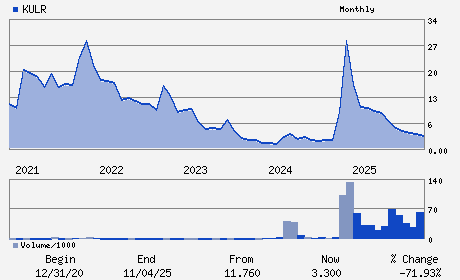

| • Price / Volume Information |

| Yesterday's Closing Price: $2.92 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,215,749 shares |

| Shares Outstanding: 45.67 (millions) |

| Market Capitalization: $133.37 (millions) |

| Beta: 1.96 |

| 52 Week High: $14.80 |

| 52 Week Low: $2.15 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-17.51% |

-16.38% |

| 12 Week |

-24.55% |

-24.93% |

| Year To Date |

-1.35% |

-1.87% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael Mo - Chief Executive Officer and Chairman

Shawn Canter - Chief Financial Officer

Michael Carpenter - Vice President

Joanna Massey - Director

Donna Grier - Director

|

|

Peer Information

KULR Technology Group, Inc. (CPCL.)

KULR Technology Group, Inc. (HIFN)

KULR Technology Group, Inc. (SEM.1)

KULR Technology Group, Inc. (DION)

KULR Technology Group, Inc. (AMKR)

KULR Technology Group, Inc. (CNXT.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC COMP-SEMIC

Sector: Computer and Technology

CUSIP: 50125G307

SIC: 3670

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/26/26

|

|

Share - Related Items

Shares Outstanding: 45.67

Most Recent Split Date: 6.00 (0.13:1)

Beta: 1.96

Market Capitalization: $133.37 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.55 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/26/26 |

|

|

|

| |