| Zacks Company Profile for Kura Oncology, Inc. (KURA : NSDQ) |

|

|

| |

| • Company Description |

| Kura Oncology, Inc. is a biopharmaceutical company. The company is involved in the discovery and development of therapeutics for the treatment of tumors and blood cancers. Its product pipeline includes small molecule drug candidates which are in different clinical trial consists of Tipifarnib-HRAS, Tipifarnib-PTCL, ERK inhibitor program and Menin MLL inhibitor program. Kura Oncology, Inc. is headquartered in La Jolla, California.

Number of Employees: 192 |

|

|

| |

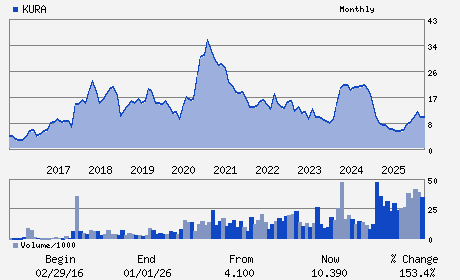

| • Price / Volume Information |

| Yesterday's Closing Price: $8.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,388,888 shares |

| Shares Outstanding: 87.02 (millions) |

| Market Capitalization: $759.66 (millions) |

| Beta: 0.22 |

| 52 Week High: $12.49 |

| 52 Week Low: $5.41 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.51% |

8.45% |

| 12 Week |

-26.95% |

-27.04% |

| Year To Date |

-15.98% |

-16.39% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Troy E. Wilson - President and Chief Executive Officer

Thomas Doyle - Senior Vice President

Helen Collins - Director

Faheem Hasnain - Director

Thomas Malley - Director

|

|

Peer Information

Kura Oncology, Inc. (CORR.)

Kura Oncology, Inc. (RSPI)

Kura Oncology, Inc. (CGXP)

Kura Oncology, Inc. (BGEN)

Kura Oncology, Inc. (GTBP)

Kura Oncology, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 50127T109

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 87.02

Most Recent Split Date: (:1)

Beta: 0.22

Market Capitalization: $759.66 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.95 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-3.08 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 8.45% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |