| Zacks Company Profile for KVH Industries, Inc. (KVHI : NSDQ) |

|

|

| |

| • Company Description |

| KVH Europe A/S is a wholly owned subsidiary of USA-based KVH Industries, Inc. KVH is a leading provider of in-motion satellite TV and communication systems, having designed, manufactured, and sold more than one lakhs mobile satellite antennas for applications on boats, RVs, trucks, buses, and automobiles. KVH Europe is the preferred supplier of marine satellite TV systems to leading powerboat builders like Sunseeker, Princess, Fairline, Rodriquez, Azimut, and Astondoa. KVH's mission is to connect mobile customers with the same digital television entertainment, communications, and Internet services that they enjoy in their home and offices.

Number of Employees: 260 |

|

|

| |

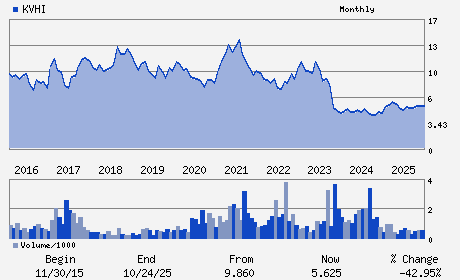

| • Price / Volume Information |

| Yesterday's Closing Price: $6.02 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 44,611 shares |

| Shares Outstanding: 19.57 (millions) |

| Market Capitalization: $117.83 (millions) |

| Beta: 0.72 |

| 52 Week High: $7.71 |

| 52 Week Low: $4.69 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.23% |

-4.84% |

| 12 Week |

-0.50% |

-0.15% |

| Year To Date |

-13.63% |

-13.26% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

75 ENTERPRISE CENTER

-

MIDDLETOWN,RI 02842

USA |

ph: 401-847-3327

fax: 401-849-0045 |

ir@kvh.com |

http://www.kvh.com |

|

|

| |

| • General Corporate Information |

Officers

Brent C. Bruun - Chief Executive Officer; President and Director

David M. Tolley - Chairman of the Board of Directors

Anthony F. Pike - Chief Financial Officer

Stephen H. Deckoff - Director

David B. Kagan - Director

|

|

Peer Information

KVH Industries, Inc. (ATGN)

KVH Industries, Inc. (AUDC)

KVH Industries, Inc. (OIVO)

KVH Industries, Inc. (ETCIA)

KVH Industries, Inc. (DIGL)

KVH Industries, Inc. (INVT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Communications Components

Sector: Computer and Technology

CUSIP: 482738101

SIC: 4899

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/10/26

|

|

Share - Related Items

Shares Outstanding: 19.57

Most Recent Split Date: (:1)

Beta: 0.72

Market Capitalization: $117.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/10/26 |

|

|

|

| |