| Zacks Company Profile for Kiwa Bio-Tech Products Group Corp. (KWBT : OTCBB) |

|

|

| |

| • Company Description |

| Kiwa Bio-Tech Products Group Corporation develops, manufactures, distributes and markets innovative, cost-effective, and environmentally safe bio-technological products for agricultural and natural resources and environmental conservation. The Company's products are designed to enhance the quality of human life by increasing the value, quality and productivity of crops and decreasing the negative environmental impact of chemicals and other wastes. It also develops a veterinary drug based on AF-01 anti-viral aerosol technology, an antiviral agent with potent inhibitory and/or viricidal effects on RNA viruses found in animals and fowls. In addition, Kiwa Bio-Tech Products Group, through its joint venture with Tianjin Challenge Feed Co., Ltd., develops, manufactures, and markets bio-feed products for livestock. It also has joint venture with Hebei Huaxing Pharmaceuticals Co., Ltd that develops, manufactures, and markets animal drugs and disinfectants, including AF-01 anti-viral aerosol technology-based products.

Number of Employees: |

|

|

| |

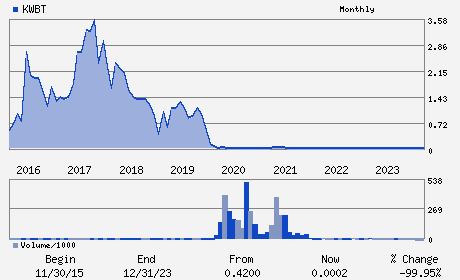

| • Price / Volume Information |

| Yesterday's Closing Price: $ |

Daily Weekly Monthly

|

| 20 Day Moving Average: shares |

| Shares Outstanding: (millions) |

| Market Capitalization: $ (millions) |

| Beta: |

| 52 Week High: $0.00 |

| 52 Week Low: $0.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

% |

% |

| 12 Week |

% |

% |

| Year To Date |

% |

% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Wade Li - Chief Executive Officer

Xiao Qiang Yu - Chie Operating Officer

Hon Man Yun - Chief Financial Officer

Qi Wang - Vice President

Yvonne Wang - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 49834X205

SIC: 2870

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding:

Most Recent Split Date: 1.00 (0.01:1)

Beta:

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: % |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |