| Zacks Company Profile for Kawasaki Heavy Industries Ltd. (KWHIY : OTC) |

|

|

| |

| • Company Description |

| Kawasaki Heavy Industries, Ltd. is engaged in the manufacture and sale of transportation equipment and industrial goods. Its Shipbuilding segment manufactures and sells submarines, and LNG and LPG carriers. The company's Rolling Stock segment manufactures electric train cars, passenger coaches and platform screen doors. Its Aerospace segment manufactures airplanes, helicopters, passenger airplanes and jet aircraft. The company's Gas Turbines and Machinery segment manufactures gas turbines, steam turbines, jet engines and prime movers. Kawasaki's Plant and Infrastructure Engineering segment produces cement, chemical, and other industrial plants. The company's Motorcycle and Engine segment offers motorcycles and all-terrain vehicles. Its Precision Machinery segment produces industrial hydraulic products and robots. Kawasaki Heavy Industries, Ltd. is headquartered in Kobe, Japan.

Number of Employees: 40,610 |

|

|

| |

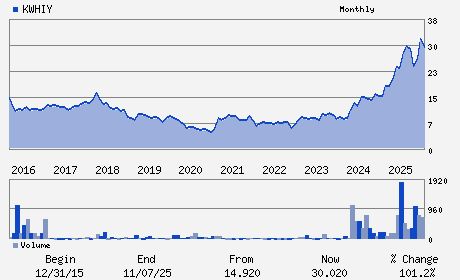

| • Price / Volume Information |

| Yesterday's Closing Price: $43.17 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 69,786 shares |

| Shares Outstanding: 418.80 (millions) |

| Market Capitalization: $18,079.56 (millions) |

| Beta: 0.63 |

| 52 Week High: $48.66 |

| 52 Week Low: $16.63 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

22.83% |

24.66% |

| 12 Week |

47.24% |

47.75% |

| Year To Date |

63.49% |

64.18% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1-14-5 Kaigan Minato-ku

-

Tokyo,M0 105-8315

JPN |

ph: 813-3435-2111

fax: 813-3436-3037 |

None |

http://www.global.kawasaki.com |

|

|

| |

| • General Corporate Information |

Officers

Yasuhiko Hashimoto - Chief Executive Officer and President

Yoshinori Kanehana - Chairman

Sukeyuki Namiki - Vice President and Senior Executive Officer

MichioYoneda - Director

Yoshiaki Tamura - Director

|

|

Peer Information

Kawasaki Heavy Industries Ltd. (B.)

Kawasaki Heavy Industries Ltd. (DXPE)

Kawasaki Heavy Industries Ltd. (AIT)

Kawasaki Heavy Industries Ltd. (GDI.)

Kawasaki Heavy Industries Ltd. (CTITQ)

Kawasaki Heavy Industries Ltd. (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 486359201

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/08/26

|

|

Share - Related Items

Shares Outstanding: 418.80

Most Recent Split Date: (:1)

Beta: 0.63

Market Capitalization: $18,079.56 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.53% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.23 |

| Current Fiscal Year EPS Consensus Estimate: $1.52 |

Payout Ratio: 0.13 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.08 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/08/26 |

|

|

|

| |