| Zacks Company Profile for Lakeland Industries, Inc. (LAKE : NSDQ) |

|

|

| |

| • Company Description |

| LAKELAND INDUSTRIES, INC. has five divisions and three wholly-owned subsidiaries: One large division manufactures disposable/limited use garments and the four smaller divisions, Chemland, manufactures suits for use by toxic waste clean up teams; Fireland Fyrepel Products, manufactures fire and heat protective apparel and protective systems for personnel; Highland, manufactures specialty safety and industrial work gloves and Uniland, manufactures industrial and medical woven cloth garments.

Number of Employees: 2,100 |

|

|

| |

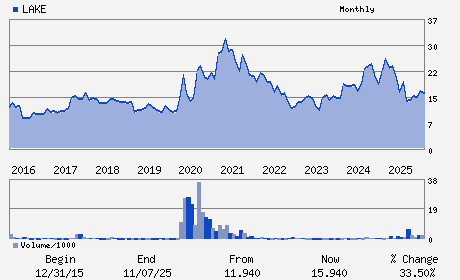

| • Price / Volume Information |

| Yesterday's Closing Price: $8.93 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 89,830 shares |

| Shares Outstanding: 9.81 (millions) |

| Market Capitalization: $87.57 (millions) |

| Beta: 1.29 |

| 52 Week High: $22.97 |

| 52 Week Low: $7.77 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.39% |

-5.10% |

| 12 Week |

-40.51% |

-40.81% |

| Year To Date |

1.02% |

0.49% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1525 PERIMETER PARKWAY SUITE 325

-

HUNTSVILLE,AL 35806

USA |

ph: 256-350-3873

fax: 631-981-9751 |

lake@mzgroup.us |

http://www.lakeland.com |

|

|

| |

| • General Corporate Information |

Officers

James M. Jenkins - President and Chief Executive Officer and Executiv

Hui (Helena) An - Chief Operating Officer

Roger D. Shannon - Chief Financial Officer and Secretary

Thomas J. McAteer - Director

Nikki L. Hamblin - Director

|

|

Peer Information

Lakeland Industries, Inc. (BRC)

Lakeland Industries, Inc. (ALGI)

Lakeland Industries, Inc. (SYNX.)

Lakeland Industries, Inc. (ADSV)

Lakeland Industries, Inc. (CDCY)

Lakeland Industries, Inc. (CSCQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: PROTECTION-SFTY

Sector: Industrial Products

CUSIP: 511795106

SIC: 3842

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 04/08/26

|

|

Share - Related Items

Shares Outstanding: 9.81

Most Recent Split Date: 7.00 (1.10:1)

Beta: 1.29

Market Capitalization: $87.57 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.34% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.02 |

Indicated Annual Dividend: $0.12 |

| Current Fiscal Year EPS Consensus Estimate: $0.63 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/08/26 |

|

|

|

| |