| Zacks Company Profile for Leggett & Platt, Incorporated (LEG : NYSE) |

|

|

| |

| • Company Description |

| Leggett and Platt Inc. is a global manufacturer that conceives, designs, and produces a wide variety of engineered components and products found in many homes, offices, and automobiles. The company's product lines include components for bedding, automotive seat and lumber systems, specialty bedding foams and private-label finished mattresses, residential as well as office furniture, flooring underlayment, adjustable beds, along with bedding industry machinery.

Number of Employees: 17,700 |

|

|

| |

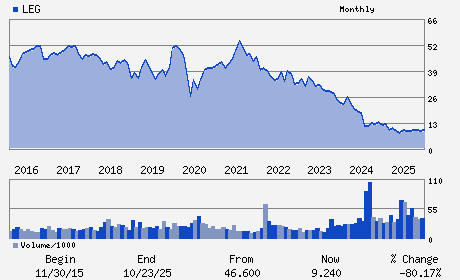

| • Price / Volume Information |

| Yesterday's Closing Price: $11.68 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,016,973 shares |

| Shares Outstanding: 135.44 (millions) |

| Market Capitalization: $1,581.90 (millions) |

| Beta: 0.71 |

| 52 Week High: $13.00 |

| 52 Week Low: $6.48 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.09% |

0.96% |

| 12 Week |

4.57% |

4.44% |

| Year To Date |

6.18% |

5.67% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Karl G. Glassman - President and Chief Executive Officer

Benjamin M. Burns - Executive Vice President and Chief Financial Offic

Tammy M. Trent - Senior Vice President and Chief Accounting Officer

Angela Barbee - Director

Robert E. Brunner - Director

|

|

Peer Information

Leggett & Platt, Incorporated (DMIF.)

Leggett & Platt, Incorporated (NCL)

Leggett & Platt, Incorporated (FCPR)

Leggett & Platt, Incorporated (AMWD)

Leggett & Platt, Incorporated (SNBR)

Leggett & Platt, Incorporated (MLKN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FURNITURE

Sector: Consumer Discretionary

CUSIP: 524660107

SIC: 2510

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 135.44

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.71

Market Capitalization: $1,581.90 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.71% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.26 |

Indicated Annual Dividend: $0.20 |

| Current Fiscal Year EPS Consensus Estimate: $1.08 |

Payout Ratio: 0.19 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.43 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/15/2025 - $0.05 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |