| Zacks Company Profile for Ligand Pharmaceuticals Incorporated (LGND : NSDQ) |

|

|

| |

| • Company Description |

| Ligand, being a biotechnology company, focuses on developing/acquiring royalty revenue generating assets and coupling them with a lean corporate cost structure. Ligand's Captisol formulation technology has allowed it to enter into several licensing deals and generate royalties. Captisol is a well validated chemically modified cyclodextrin that is designed to improve safety and solubility, stability, and bioavailability or lessen the volatility, irritation, smell or taste of drugs. Ligand has merged with CyDex. By this, it added an antibody-generating platform, OmniAb, to the company's portfolio. Its other technology platforms include antigen discovery platform & protein expression platform. All these technologies have created a strong platform for Ligand to seek new licenses and partnerships. Ligand has partnership agreements with leading healthcare companies like Novartis, Amgen, Merck, Pfizer, Celgene, Gilead & Lilly, etc. The company continues to buy smaller companies to increase its technology platforms.

Number of Employees: 68 |

|

|

| |

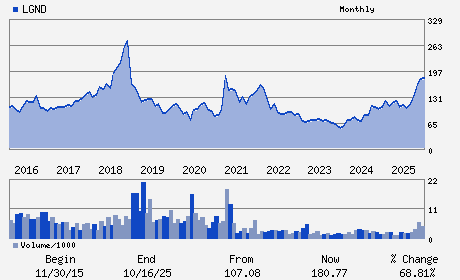

| • Price / Volume Information |

| Yesterday's Closing Price: $202.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 177,648 shares |

| Shares Outstanding: 19.94 (millions) |

| Market Capitalization: $4,039.08 (millions) |

| Beta: 1.17 |

| 52 Week High: $212.49 |

| 52 Week Low: $93.58 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.33% |

3.74% |

| 12 Week |

9.68% |

9.12% |

| Year To Date |

7.13% |

6.57% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

555 HERITAGE DRIVE SUITE 200

-

JUPITER,FL 33458

USA |

ph: 858-550-7500

fax: 858-550-1826 |

investors@ligand.com |

http://www.ligand.com |

|

|

| |

| • General Corporate Information |

Officers

Todd C. Davis - Chief Executive Officer and Director

John W. Kozarich - Chairman

Octavio Espinoza - Chief Financial Officer

Jason M. Aryeh - Director

Nancy R. Gray - Director

|

|

Peer Information

Ligand Pharmaceuticals Incorporated (CORR.)

Ligand Pharmaceuticals Incorporated (RSPI)

Ligand Pharmaceuticals Incorporated (CGXP)

Ligand Pharmaceuticals Incorporated (BGEN)

Ligand Pharmaceuticals Incorporated (GTBP)

Ligand Pharmaceuticals Incorporated (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 53220K504

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 19.94

Most Recent Split Date: 11.00 (0.17:1)

Beta: 1.17

Market Capitalization: $4,039.08 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.94 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.20 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |