| Zacks Company Profile for LKQ Corporation (LKQ : NSDQ) |

|

|

| |

| • Company Description |

| LKQ Corporation is providers of replacement parts, components, and systems that are required to repair and maintain vehicles. Using these parts improve the functionality and performance of vehicles. The company distributes aftermarket collision and mechanical products, recycled collision and mechanical products bumper covers and lights; as well as remanufactured engines and transmissions. LKQ Corp provides alternative vehicle collision replacement products and alternative vehicle mechanical replacement products globally. Currently, the company's three reportable segments are: North America - The segment sells aftermarket, recycled, remanufactured, refurbished and OEM parts to professional collision and mechanical automobile repair businesses. Europe - The segment is expanding its presence in Europe through four key acquisitions: ECP, Sator, Rhiag and Stahlgruber. Specialty - The segment was formed after the acquisition of Keystone Specialty.

Number of Employees: 44,000 |

|

|

| |

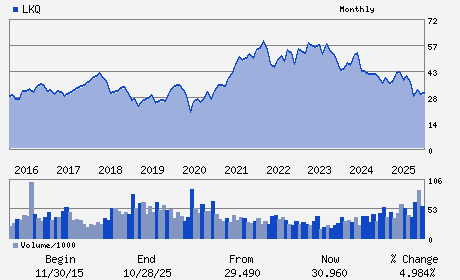

| • Price / Volume Information |

| Yesterday's Closing Price: $32.78 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,154,850 shares |

| Shares Outstanding: 255.13 (millions) |

| Market Capitalization: $8,363.24 (millions) |

| Beta: 0.89 |

| 52 Week High: $44.82 |

| 52 Week Low: $28.13 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.80% |

2.19% |

| 12 Week |

13.54% |

12.96% |

| Year To Date |

8.54% |

7.97% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Justin L. Jude - President and Chief Executive Officer; Director

Rick Galloway - Senior Vice President and Chief Financial Officer

Todd G. Cunningham - Vice President Finance and Controller

Patrick Berard - Director

Andrew Clarke - Director

|

|

Peer Information

LKQ Corporation (T.BYD)

LKQ Corporation (ELEEF)

LKQ Corporation (MZTAQ)

LKQ Corporation (EDEL)

LKQ Corporation (AIRW.)

LKQ Corporation (CRV)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO/TRUCK-REPL

Sector: Auto/Tires/Trucks

CUSIP: 501889208

SIC: 5010

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 255.13

Most Recent Split Date: 9.00 (2.00:1)

Beta: 0.89

Market Capitalization: $8,363.24 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.66% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.68 |

Indicated Annual Dividend: $1.20 |

| Current Fiscal Year EPS Consensus Estimate: $3.06 |

Payout Ratio: 0.39 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.12 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |