| Zacks Company Profile for Eli Lilly and Company (LLY : NYSE) |

|

|

| |

| • Company Description |

| Eli Lilly and Company, one of the world's largest pharmaceutical companies, boasts a diversified product profile including a solid lineup of new successful drugs. It also has a dependable pipeline as it navigates through challenges like patent expirations of several drugs and rising pricing pressure on its U.S. diabetes franchise. Its pharmaceutical product categories are neuroscience, diabetes, oncology, immunology and others. Over the past few years, Lilly has been actively seeking acquisitions and in-licensing deals to boost its product portfolio and pipeline. The purchase of ImClone Systems brought with it cancer compound, Erbitux. The acquisition of ICOS Corporation gave Lilly full control over erectile dysfunction drug, Cialis. Its other acquisitions include Hypnion, Inc., CoLucid Pharmaceuticals added Reyvow for acute migraine, Loxo Oncology and Dermira. Lilly has collaboration agreements with several companies including Incyte, Boehringer Ingelheim and Innovent Biologics among others.

Number of Employees: 50,000 |

|

|

| |

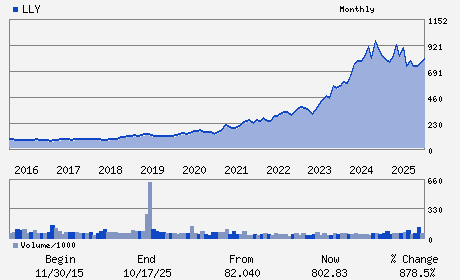

| • Price / Volume Information |

| Yesterday's Closing Price: $1,051.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,625,274 shares |

| Shares Outstanding: 943.36 (millions) |

| Market Capitalization: $992,402.56 (millions) |

| Beta: 0.40 |

| 52 Week High: $1,133.95 |

| 52 Week Low: $623.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.43% |

2.32% |

| 12 Week |

4.13% |

4.00% |

| Year To Date |

-2.11% |

-2.59% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David Ricks - Chief Executive Officer; Chairman and President

Lucas Montarce - Executive Vice President and Chief Financial Offic

Donald Zakrowski - Senior Vice President; Finance; and Chief Accounti

Ralph Alvarez - Director

Kimberly Johnson - Director

|

|

Peer Information

Eli Lilly and Company (AGN.)

Eli Lilly and Company (NVS)

Eli Lilly and Company (NVO)

Eli Lilly and Company (LLY)

Eli Lilly and Company (RHHBY)

Eli Lilly and Company (JNJ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Large Cap Pharma

Sector: Medical

CUSIP: 532457108

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 943.36

Most Recent Split Date: 10.00 (2.00:1)

Beta: 0.40

Market Capitalization: $992,402.56 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.66% |

| Current Fiscal Quarter EPS Consensus Estimate: $7.35 |

Indicated Annual Dividend: $6.92 |

| Current Fiscal Year EPS Consensus Estimate: $34.71 |

Payout Ratio: 0.25 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.24 |

| Estmated Long-Term EPS Growth Rate: 24.76% |

Last Dividend Paid: 02/13/2026 - $1.73 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |