| Zacks Company Profile for Live Microsystems Inc. (LMSC : OTC) |

|

|

| |

| • Company Description |

| Live Microsystems, Inc. is a mobile internet powerhouse. The company provides digital entertainment solutions to network operators, consumer device manufacturers, brands and media companies entering the mobile market. Its integrated suite of content services includes applications, video, games, ring back tones, ringtones, full-track music, e-books and more as well as application and portal development, mobile advertising solutions, integrated content publishing and merchandising and turnkey managed VAS operations. Live Microsystems, Inc., formerly known as Livewire Mobile, Inc., is based in Radnor, PA.

Number of Employees: |

|

|

| |

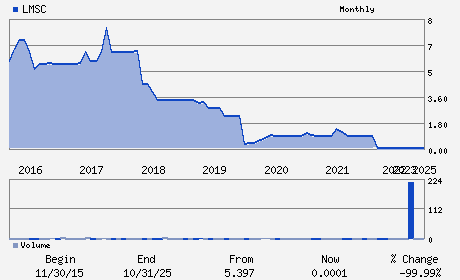

| • Price / Volume Information |

| Yesterday's Closing Price: $ |

Daily Weekly Monthly

|

| 20 Day Moving Average: shares |

| Shares Outstanding: 203.18 (millions) |

| Market Capitalization: $ (millions) |

| Beta: |

| 52 Week High: $0.00 |

| 52 Week Low: $0.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

% |

% |

| 12 Week |

% |

% |

| Year To Date |

% |

% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

JOEL HUGHES - C.E.O & Chairman

TODDD. DONAHUE - Chief Financial Officer

THOMAS R. DUSENBERRY - Director

W. FRANK KING, PH.D. - Director

ROBERT M. PONS - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SERVICES

Sector: Computer and Technology

CUSIP: 53803W206

SIC: 3661

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 203.18

Most Recent Split Date: 1.00 (0.07:1)

Beta:

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: % |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |