| Zacks Company Profile for Lowe's Companies, Inc. (LOW : NYSE) |

|

|

| |

| • Company Description |

| Lowe's Companies, Inc. operates as a home improvement company and offers a line of products for maintenance, repair, remodeling, and decorating. The company provides home improvement products in various categories, such as lumber and building materials, tools and hardware, appliances, fashion fixtures, rough plumbing and electrical, seasonal living, lawn and garden, paint, millwork, flooring, kitchens, outdoor power equipment, and home fashions. It also offers installation services through independent contractors in various product categories; extended protection plans; and in-warranty and out-of-warranty repair services. The company sells its national brand-name merchandise and private branded products to homeowners, renters, and professional customers; and retail customers comprising individual homeowners and renters.

Number of Employees: 270,000 |

|

|

| |

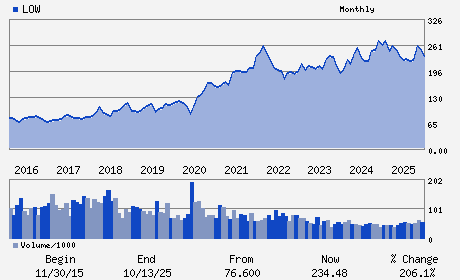

| • Price / Volume Information |

| Yesterday's Closing Price: $264.57 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,787,092 shares |

| Shares Outstanding: 560.95 (millions) |

| Market Capitalization: $148,410.94 (millions) |

| Beta: 0.98 |

| 52 Week High: $293.06 |

| 52 Week Low: $206.39 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.93% |

-0.07% |

| 12 Week |

6.48% |

6.35% |

| Year To Date |

9.71% |

9.17% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Marvin R. Ellison - Chief Executive Officer; Chairman and President

Brandon J. Sink - Executive Vice President; Chief Financial Officer

Dan C. Griggs - Senior Vice President

Raul Alvarez - Director

David H. Batchelder - Director

|

|

Peer Information

Lowe's Companies, Inc. (ETD)

Lowe's Companies, Inc. (SUPX)

Lowe's Companies, Inc. (LECH)

Lowe's Companies, Inc. (LIN.)

Lowe's Companies, Inc. (RBDSQ)

Lowe's Companies, Inc. (BBAO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-HOME FRN

Sector: Retail/Wholesale

CUSIP: 548661107

SIC: 5211

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/20/26

|

|

Share - Related Items

Shares Outstanding: 560.95

Most Recent Split Date: 7.00 (2.00:1)

Beta: 0.98

Market Capitalization: $148,410.94 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.81% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.99 |

Indicated Annual Dividend: $4.80 |

| Current Fiscal Year EPS Consensus Estimate: $12.62 |

Payout Ratio: 0.39 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.06 |

| Estmated Long-Term EPS Growth Rate: 3.65% |

Last Dividend Paid: 01/21/2026 - $1.20 |

| Next EPS Report Date: 05/20/26 |

|

|

|

| |