| Zacks Company Profile for Lumen Technologies, Inc. (LUMN : NYSE) |

|

|

| |

| • Company Description |

| Lumen Technologies, being a leading rural local exchange carrier, provides a range of telecom services, including local and long-distance voice, wholesale network access, high-speed Internet access, best-in-class communications & IT solutions, managed hosting and colocation services, and video services to its business and residential customers. Its terrestrial and subsea fiber optic long-haul network throughout N. America, Europe, Latin America and Asia Pacific connects to metropolitan fiber networks. It has 2 reportable segments: Business (comprising, International & Global Accounts Management, Large Enterprise, Mid-Market Enterprise and Wholesale) & Mass Markets (includig, Consumer and Small Business Group). Business segment serves business, wholesale and government customers of all sizes. Its products are: Compute & Application Services, IP & Data Services, Fiber Infrastructure Services & Voice and Other. Mass Markets segment provides reliable, secure & high-performance connectivity with related services.

Number of Employees: 24,000 |

|

|

| |

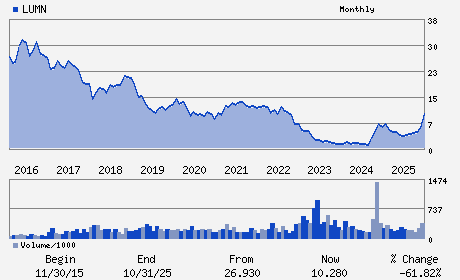

| • Price / Volume Information |

| Yesterday's Closing Price: $6.80 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 15,966,694 shares |

| Shares Outstanding: 1,024.37 (millions) |

| Market Capitalization: $6,965.71 (millions) |

| Beta: 1.56 |

| 52 Week High: $11.95 |

| 52 Week Low: $3.01 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-23.85% |

-22.80% |

| 12 Week |

-18.76% |

-19.17% |

| Year To Date |

-12.48% |

-12.94% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kate Johnson - President and Chief Executive Officer

T. Michael Glenn - Non-Executive Chairman

Chris Stansbury - Executive Vice President and Chief Financial Offic

Quincy L. Allen - Director

Martha Helena Bejar - Director

|

|

Peer Information

Lumen Technologies, Inc. (IDAI.)

Lumen Technologies, Inc. (RPID.)

Lumen Technologies, Inc. (ACTT.)

Lumen Technologies, Inc. (CVST)

Lumen Technologies, Inc. (GTTLQ)

Lumen Technologies, Inc. (BCE)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Diversified Comm Services

Sector: Utilities

CUSIP: 550241103

SIC: 4813

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 1,024.37

Most Recent Split Date: 4.00 (1.50:1)

Beta: 1.56

Market Capitalization: $6,965.71 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.05 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.10 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |