| Zacks Company Profile for LyondellBasell Industries N.V. (LYB : NYSE) |

|

|

| |

| • Company Description |

| LyondellBasell Industries N.V. is among the leading plastics, chemical and refining companies globally. The products are used in electronics, automotive parts, packaging, construction materials and biofuels. LyondellBasell operates through six segments - The Olefins & Polyolefins Americas division makes and markets olefins, including ethylene and ethylene co-products, and polyolefins. The Olefins & Polyolefins - Europe, Asia, International is engaged in the production and distribution of olefins including ethylene and ethylene co-products. The Advanced Polymer Solutions segment manufactures and markets Compounding & Solutions and Advanced Polymers. The Refining segment refines heavy, high-sulfur crude oil and different types of other crude oils. The Technology segment develops and licenses chemical and polyolefin process technologies and also makes and distributes polyolefin catalysts.

Number of Employees: 18,970 |

|

|

| |

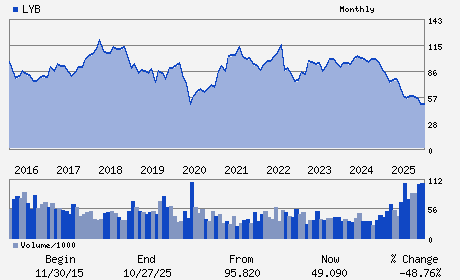

| • Price / Volume Information |

| Yesterday's Closing Price: $57.88 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,394,103 shares |

| Shares Outstanding: 322.17 (millions) |

| Market Capitalization: $18,647.20 (millions) |

| Beta: 0.64 |

| 52 Week High: $78.41 |

| 52 Week Low: $41.58 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.18% |

16.77% |

| 12 Week |

36.90% |

36.20% |

| Year To Date |

33.67% |

32.97% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Peter Vanacker - Chief Executive Officer

Jacques Aigrain - Chair of the Board

Agustin Izquierdo - Executive Vice President and Chief Financial Offic

Matthew D. Hayes - Senior Vice President; Chief Accounting Officer

Lincoln Benet - Director

|

|

Peer Information

LyondellBasell Industries N.V. (ENFY)

LyondellBasell Industries N.V. (EMLIF)

LyondellBasell Industries N.V. (GPLB)

LyondellBasell Industries N.V. (BCPUQ)

LyondellBasell Industries N.V. (CYT.)

LyondellBasell Industries N.V. (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: N53745100

SIC: 2860

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 322.17

Most Recent Split Date: (:1)

Beta: 0.64

Market Capitalization: $18,647.20 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.77% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.33 |

Indicated Annual Dividend: $2.76 |

| Current Fiscal Year EPS Consensus Estimate: $2.88 |

Payout Ratio: 3.22 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 2.44 |

| Estmated Long-Term EPS Growth Rate: 48.35% |

Last Dividend Paid: 12/01/2025 - $1.37 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |