| Zacks Company Profile for Mattel, Inc. (MAT : NSDQ) |

|

|

| |

| • Company Description |

| Mattel Inc. is the world's largest manufacturer of toys. The company's products are sold directly to retailers and wholesalers in most European, Latin American and Asian countries as well as in Australia, Canada and New Zealand through the Mattel Girls & Boys Brands, Fisher-Price Brands, American Girl Brands, and Construction and Arts & Crafts Brands. The products are sold through agents as well as distributors in countries where Mattel has no direct presence. Mattel's portfolio of global brands has vast intellectual property potential. The brands and products are widely classified as Power Brands and Toy Box. The company's Power Brands include Barbie, Hot Wheels, Fisher-Price, Thomas & Friends, and American Girl. Toy Box includes new and innovative products as well as time-tested classics from Mattel-owned and licensed entertainment properties.

Number of Employees: 31,000 |

|

|

| |

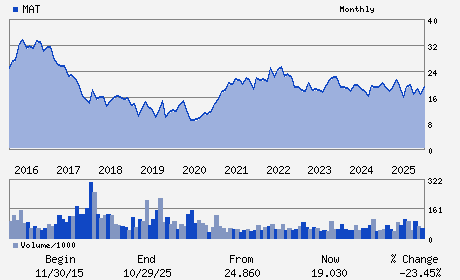

| • Price / Volume Information |

| Yesterday's Closing Price: $16.95 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,315,110 shares |

| Shares Outstanding: 302.20 (millions) |

| Market Capitalization: $5,122.29 (millions) |

| Beta: 0.72 |

| 52 Week High: $22.48 |

| 52 Week Low: $13.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-18.86% |

-18.15% |

| 12 Week |

-19.86% |

-19.96% |

| Year To Date |

-14.57% |

-14.98% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ynon Kreiz - Chairman of the Board and Chief Executive Officer

Paul Ruh - Chief Financial Officer

Yoon Hugh - Senior Vice President and Corporate Controller

Adriana Cisneros - Director

Diana Ferguson - Director

|

|

Peer Information

Mattel, Inc. (EXEXA)

Mattel, Inc. (HERE)

Mattel, Inc. (SSTRF)

Mattel, Inc. (ATN.)

Mattel, Inc. (ATVI)

Mattel, Inc. (JAKK)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TOYS/GAME/HOBBY

Sector: Consumer Discretionary

CUSIP: 577081102

SIC: 3942

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 302.20

Most Recent Split Date: 3.00 (1.25:1)

Beta: 0.72

Market Capitalization: $5,122.29 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.23 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.31 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 5.46% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |