| Zacks Company Profile for Mitchells & Butlers Plc (MBPFF : OTC) |

|

|

| |

| • Company Description |

| Mitchells & Butlers Plc is engaged in restaurants & pubs business. The company's brands include Sizzling Pubs, Vintage Inns, Harvester, Ember Inns, Toby Carvery, Crown Carveries, Castle, Nicholson's, O'Neill's, Alex, All Bar One, Miller & Carter, Browns, Innkeeper's Lodge, Oak Tree, Orchid Pubs and Premium Country Pubs. Its business segment consists of Retail Operating and Property business. Retail Operating business manages Group's retail operating units. Property business holds the Group's freehold and leasehold property. Mitchells & Butlers Plc is headquartered in Birmingham, the United Kingdom.

Number of Employees: |

|

|

| |

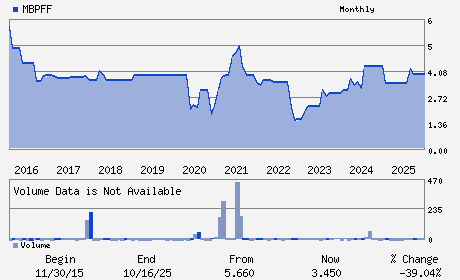

| • Price / Volume Information |

| Yesterday's Closing Price: $3.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1 shares |

| Shares Outstanding: 598.06 (millions) |

| Market Capitalization: $2,039.38 (millions) |

| Beta: 0.49 |

| 52 Week High: $3.70 |

| 52 Week Low: $2.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.00% |

0.87% |

| 12 Week |

-1.16% |

-1.28% |

| Year To Date |

4.92% |

4.41% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Philip Charles Urban - Chief Executive Officer

Bob Ivell - Chairman

Tim Jones - Chief Financial Officer

Keith Browne - Director

Jane Moriarty - Director

|

|

Peer Information

Mitchells & Butlers Plc (BH)

Mitchells & Butlers Plc (BUCA)

Mitchells & Butlers Plc (BUNZQ)

Mitchells & Butlers Plc (FRRG)

Mitchells & Butlers Plc (CHEF.)

Mitchells & Butlers Plc (BGMTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-RESTRNTS

Sector: Retail/Wholesale

CUSIP: G61614122

SIC: 5812

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: -

Next Expected EPS Date: 02/27/26

|

|

Share - Related Items

Shares Outstanding: 598.06

Most Recent Split Date: (:1)

Beta: 0.49

Market Capitalization: $2,039.38 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/27/26 |

|

|

|

| |