| Zacks Company Profile for MetroCity Bankshares, Inc. (MCBS : NSDQ) |

|

|

| |

| • Company Description |

| MetroCity Bankshares Inc. is a bank holding company for its wholly-owned banking subsidiary, Metro City Bank. It offers savings accounts, debit and credit cards, business and personal loans, mortgages, cash management, line of credit, online banking and e-statements. The company operates primarily in Alabama, Florida, Georgia, New York, New Jersey, Texas and Virginia. MetroCity Bankshares Inc. is based in ATLANTA, Ga.

Number of Employees: 240 |

|

|

| |

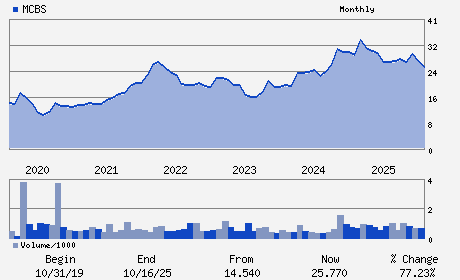

| • Price / Volume Information |

| Yesterday's Closing Price: $28.10 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 71,035 shares |

| Shares Outstanding: 25.48 (millions) |

| Market Capitalization: $716.01 (millions) |

| Beta: 0.72 |

| 52 Week High: $31.06 |

| 52 Week Low: $24.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.25% |

0.62% |

| 12 Week |

4.77% |

4.64% |

| Year To Date |

5.88% |

5.36% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

5114 BUFORD HIGHWAY

-

DORAVILLE,GA 30340

USA |

ph: 770-455-4989

fax: - |

None |

http://www.metrocitybank.bank |

|

|

| |

| • General Corporate Information |

Officers

Nack Y. Paek - Chairman and Chief Executive Officer

Farid Tan - President

Frank Glover - Director

William J. Hungeling - Director

Howard Hwasaeng Kim - Director

|

|

Peer Information

MetroCity Bankshares, Inc. (TSFG)

MetroCity Bankshares, Inc. (ABCB)

MetroCity Bankshares, Inc. (CFNL)

MetroCity Bankshares, Inc. (CPKF)

MetroCity Bankshares, Inc. (HIB)

MetroCity Bankshares, Inc. (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 59165J105

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/17/26

|

|

Share - Related Items

Shares Outstanding: 25.48

Most Recent Split Date: (:1)

Beta: 0.72

Market Capitalization: $716.01 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.56% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.38 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.07 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/04/2026 - $0.25 |

| Next EPS Report Date: 04/17/26 |

|

|

|

| |