| Zacks Company Profile for Microchip Technology Incorporated (MCHP : NSDQ) |

|

|

| |

| • Company Description |

| Microchip Technology Inc. develops and manufactures microcontrollers, memory and analog and interface products for embedded control systems, which are small, low-power computers designed to perform specific tasks. The company has now three major product lines: Microcontrollers (this product portfolio comprises 8-bit, 16-bit and 32-bit PIC microcontrollers and 16-bit dsPIC digital signal controllers) and Analog (these products consist of several families with approximately 800 power management, linear, mixed-signal, thermal management, RF Linear drivers, safety and security, and interface products).

Number of Employees: 19,400 |

|

|

| |

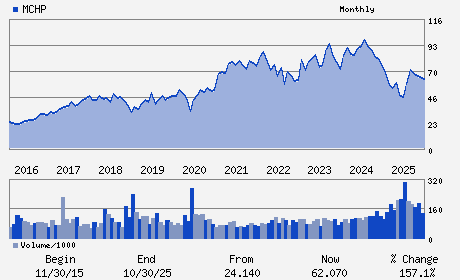

| • Price / Volume Information |

| Yesterday's Closing Price: $74.64 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,343,396 shares |

| Shares Outstanding: 541.14 (millions) |

| Market Capitalization: $40,390.35 (millions) |

| Beta: 1.45 |

| 52 Week High: $83.35 |

| 52 Week Low: $34.13 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.69% |

-0.83% |

| 12 Week |

13.42% |

13.28% |

| Year To Date |

17.14% |

16.57% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Steve Sanghi - Executive Chairman of the Board; Chief Executive O

Richard J. Simoncic - Chief Operating Officer

J. Eric Bjornholt - Senior Vice President and Chief Financial Officer

Mathew B. Bunker - Senior Vice President

Ellen L. Barker - Director

|

|

Peer Information

Microchip Technology Incorporated (ADI)

Microchip Technology Incorporated (MXL)

Microchip Technology Incorporated (SMTC)

Microchip Technology Incorporated (SLAB)

Microchip Technology Incorporated (MCHP)

Microchip Technology Incorporated (MCRL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SEMI-ANALOG & MIXED

Sector: Computer and Technology

CUSIP: 595017104

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 541.14

Most Recent Split Date: 10.00 (2.00:1)

Beta: 1.45

Market Capitalization: $40,390.35 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.44% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.38 |

Indicated Annual Dividend: $1.82 |

| Current Fiscal Year EPS Consensus Estimate: $1.14 |

Payout Ratio: 2.28 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 1.50 |

| Estmated Long-Term EPS Growth Rate: 34.96% |

Last Dividend Paid: 02/23/2026 - $0.46 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |