| Zacks Company Profile for Monarch Casino & Resort, Inc. (MCRI : NSDQ) |

|

|

| |

| • Company Description |

| Monarch Casino & Resort, Inc. is dedicated to deliver the ultimate guest experience by providing exceptional services as well as the latest gaming, dining and hospitality amenities. With a main focus on their guests' superior expectations, they continue to aggressively reinvest in our properties. As a market leader, they invite them to become more familiar with their company, their operations and their management team. Monarch Casino & Resort, Inc., through its subsidiaries, owns and operates the Atlantis Casino Resort Spa, a hotel/casino facility in Reno, Nevada, and the Monarch Black Hawk Casino in Black Hawk, Colorado, approximately 40 miles west of Denver.

Number of Employees: 2,740 |

|

|

| |

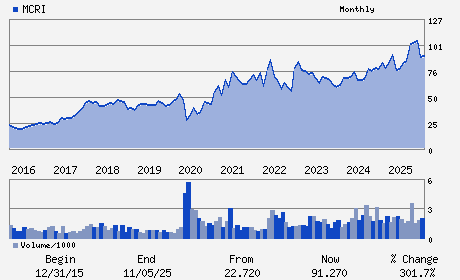

| • Price / Volume Information |

| Yesterday's Closing Price: $96.10 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 122,072 shares |

| Shares Outstanding: 17.89 (millions) |

| Market Capitalization: $1,718.86 (millions) |

| Beta: 1.29 |

| 52 Week High: $113.88 |

| 52 Week Low: $69.99 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.99% |

5.91% |

| 12 Week |

0.09% |

-0.03% |

| Year To Date |

0.42% |

-0.07% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3800 S VIRGINIA STREET

-

RENO,NV 89502

USA |

ph: 775-335-4600

fax: 775-332-9171 |

None |

http://www.monarchcasino.com |

|

|

| |

| • General Corporate Information |

Officers

John Farahi - Chief Executive Officer

Bob Farahi - President; Secretary and Director

Edwin S. Koenig - Chief Accounting Officer

Paul Andrews - Director

Hope Taitz - Director

|

|

Peer Information

Monarch Casino & Resort, Inc. (CHLD.)

Monarch Casino & Resort, Inc. (FGRD)

Monarch Casino & Resort, Inc. (CGMI.)

Monarch Casino & Resort, Inc. (AGAM.)

Monarch Casino & Resort, Inc. (ASCA.)

Monarch Casino & Resort, Inc. (BYD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: GAMING

Sector: Consumer Discretionary

CUSIP: 609027107

SIC: 7011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/28/26

|

|

Share - Related Items

Shares Outstanding: 17.89

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.29

Market Capitalization: $1,718.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.25% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.15 |

Indicated Annual Dividend: $1.20 |

| Current Fiscal Year EPS Consensus Estimate: $5.95 |

Payout Ratio: 0.22 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/01/2025 - $0.30 |

| Next EPS Report Date: 04/28/26 |

|

|

|

| |