| Zacks Company Profile for Mondelez International, Inc. (MDLZ : NSDQ) |

|

|

| |

| • Company Description |

| Mondelez International, Inc. is a global snacks company. Mondelez was previously known as Kraft Foods, Inc. The comapny product categories include chocolates, biscuits, gum and candy, beverages and cheese & grocery products. The company teamed up with Post Consumer Brands, a business unit of Post Holdings, to create two new cookie-inspired breakfast cereals. Mondelez's operating segments include Latin America, Asia, Middle East & Africa, Europe and North America..

Number of Employees: 91,000 |

|

|

| |

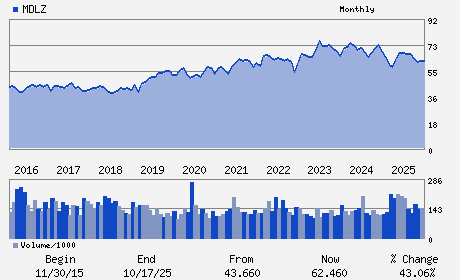

| • Price / Volume Information |

| Yesterday's Closing Price: $60.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 10,362,221 shares |

| Shares Outstanding: 1,281.85 (millions) |

| Market Capitalization: $77,474.74 (millions) |

| Beta: 0.38 |

| 52 Week High: $71.15 |

| 52 Week Low: $51.20 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.98% |

4.40% |

| 12 Week |

10.37% |

9.81% |

| Year To Date |

12.28% |

11.69% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Dirk Van de Put - Chief Executive Officer and Chairman

Luca Zaramella - Chief Operating Officer and Chief Financial Office

Brian Stevens - Senior Vice President and Chief Accounting Officer

Ertharin Cousin - Director

Cees 't Hart - Director

|

|

Peer Information

Mondelez International, Inc. (CDSCY)

Mondelez International, Inc. (HDNHY)

Mondelez International, Inc. (CPB)

Mondelez International, Inc. (AMNF)

Mondelez International, Inc. (GMFIY)

Mondelez International, Inc. (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 609207105

SIC: 2000

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 1,281.85

Most Recent Split Date: (:1)

Beta: 0.38

Market Capitalization: $77,474.74 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.31% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.65 |

Indicated Annual Dividend: $2.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.04 |

Payout Ratio: 0.68 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: 0.16 |

| Estmated Long-Term EPS Growth Rate: 7.89% |

Last Dividend Paid: 12/31/2025 - $0.50 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |