| Zacks Company Profile for Medtronic PLC (MDT : NYSE) |

|

|

| |

| • Company Description |

| Medtronic, Inc. acquired Ireland-based Covidien plc. The acquisition resulted in the formation of a new holding company incorporated in Ireland - Medtronic plc. The company currently generates revenues from four major segments - namely Cardiovascular Portfolio, Medical Surgical Portfolio, Neuroscience Portfolio and Diabetes. The Cardiovascular Portfolio, formerly reported as the Cardiac and Vascular Group, includes the Cardiac Rhythm & Heart Failure, Structural Heart & Aortic and Coronary & Peripheral Vascular divisions. The Medical Surgical Portfolio, formerly reported as the Minimally Invasive Therapies Group, includes the Surgical Innovations and the Respiratory, Gastrointestinal & Renal divisions. Neuroscience consists of Cranial & Spinal Technologies, Specialty The Neuroscience Portfolio, formerly reported as the Restorative Therapies Group, includes the Cranial & Spinal Technologies, Specialty Therapies, and Neuromodulation divisions.

Number of Employees: 95,000 |

|

|

| |

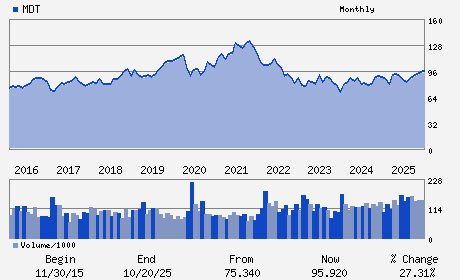

| • Price / Volume Information |

| Yesterday's Closing Price: $97.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,826,138 shares |

| Shares Outstanding: 1,283.89 (millions) |

| Market Capitalization: $125,384.20 (millions) |

| Beta: 0.71 |

| 52 Week High: $106.33 |

| 52 Week Low: $79.55 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.15% |

-4.32% |

| 12 Week |

-3.65% |

-3.77% |

| Year To Date |

1.67% |

1.17% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Geoffrey S. Martha - Chairman and Chief Executive Officer

Thierry Pieton - Executive Vice President and Chief Financial Offic

Matthew Walter - Senior Vice President

Ivan K. Fong - Executive Vice President; General Counsel and Secr

Denise L. Blomquist - Vice President; Global Controller and Chief Accoun

|

|

Peer Information

Medtronic PLC (BJCT)

Medtronic PLC (CADMQ)

Medtronic PLC (APNO)

Medtronic PLC (UPDC)

Medtronic PLC (IMTIQ)

Medtronic PLC (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: G5960L103

SIC: 3845

|

|

Fiscal Year

Fiscal Year End: April

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/20/26

|

|

Share - Related Items

Shares Outstanding: 1,283.89

Most Recent Split Date: 9.00 (2.00:1)

Beta: 0.71

Market Capitalization: $125,384.20 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.91% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.67 |

Indicated Annual Dividend: $2.84 |

| Current Fiscal Year EPS Consensus Estimate: $5.64 |

Payout Ratio: 0.51 |

| Number of Estimates in the Fiscal Year Consensus: 13.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 7.06% |

Last Dividend Paid: 12/26/2025 - $0.71 |

| Next EPS Report Date: 05/20/26 |

|

|

|

| |