| Zacks Company Profile for MDU Resources Group, Inc. (MDU : NYSE) |

|

|

| |

| • Company Description |

| MDU Resources Group, Inc. is a utility natural gas distribution company. It provides natural resource products and related services, essential for energy transportation, regulated energy delivery and construction materials & services business. The company operates through regulated energy delivery platform and construction materials and services platform. It has five reportable business segments: Electric, Natural gas distribution, Pipeline, Construction materials and contracting, and Construction services. The Electric segment and The Natural Gas Distribution segment generate, transmit, and distribute electricity and gas respectively, in many states in the U.S. The Pipeline segment provides natural gas transportation, underground storage and gathering services. The Construction Materials and Contracting segment mines, processes as well as sells construction aggregates, produces & sells asphalt mix, and supplies ready-mixed concrete. The Construction Services segment provides all contracting related services.

Number of Employees: 2,096 |

|

|

| |

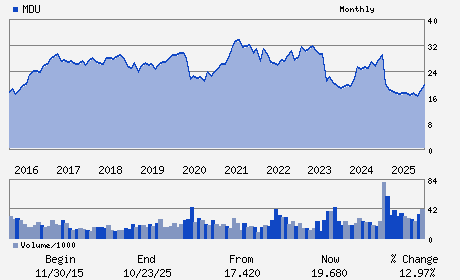

| • Price / Volume Information |

| Yesterday's Closing Price: $20.68 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,836,541 shares |

| Shares Outstanding: 204.38 (millions) |

| Market Capitalization: $4,226.64 (millions) |

| Beta: 0.74 |

| 52 Week High: $21.49 |

| 52 Week Low: $15.04 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.83% |

1.71% |

| 12 Week |

7.37% |

7.24% |

| Year To Date |

5.94% |

5.43% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1200 WEST CENTURY AVENUE P.O. Box 5650

-

BISMARCK,ND 58506

USA |

ph: 701-530-1000

fax: 701-222-7606 |

investor@mduresources.com |

http://www.mdu.com |

|

|

| |

| • General Corporate Information |

Officers

Nicole A. Kivisto - Chief Executive Officer; President

Darrel T. Anderson - Chair of the Board and Director

Jason L. Vollmer - Chief Financial Officer

Stephanie A. Sievert - Chief Accounting and Regulatory Affairs Officer

Vernon A. Dosch - Director

|

|

Peer Information

MDU Resources Group, Inc. (KSE)

MDU Resources Group, Inc. (BIPC)

MDU Resources Group, Inc. (T.CU)

MDU Resources Group, Inc. (CNIG)

MDU Resources Group, Inc. (GAS.)

MDU Resources Group, Inc. (EGAS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: UTIL-GAS DISTR

Sector: Utilities

CUSIP: 552690109

SIC: 1400

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 204.38

Most Recent Split Date: 7.00 (1.50:1)

Beta: 0.74

Market Capitalization: $4,226.64 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.71% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.39 |

Indicated Annual Dividend: $0.56 |

| Current Fiscal Year EPS Consensus Estimate: $0.98 |

Payout Ratio: 0.60 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.16 |

| Estmated Long-Term EPS Growth Rate: 5.96% |

Last Dividend Paid: 12/11/2025 - $0.14 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |