| Zacks Company Profile for Methode Electronics, Inc. (MEI : NYSE) |

|

|

| |

| • Company Description |

| Methode Electronics, Inc. is a global manufacturer of electronic components and subsystems. Methode designs, manufactures and markets devices employing electrical, electronic, wireless, sensing and optical technologies. Methode's components are found in the primary end-markets of the automotive, appliance, communications, aerospace, rail and other transportation industries, and the consumer and industrial equipment markets.

Number of Employees: 6,500 |

|

|

| |

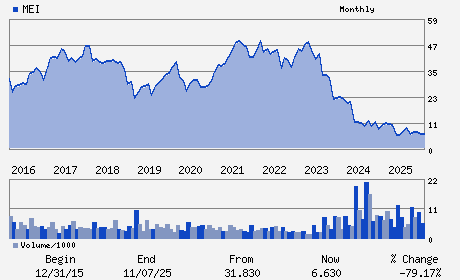

| • Price / Volume Information |

| Yesterday's Closing Price: $8.46 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 352,576 shares |

| Shares Outstanding: 35.41 (millions) |

| Market Capitalization: $299.55 (millions) |

| Beta: 1.06 |

| 52 Week High: $10.97 |

| 52 Week Low: $5.08 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.88% |

6.81% |

| 12 Week |

21.03% |

20.88% |

| Year To Date |

27.41% |

26.79% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

8750 WEST BRYN MAWR AVENUE SUITE 1000

-

CHICAGO,IL 60631

USA |

ph: 708-867-6777

fax: 708-867-6999 |

ir@methode.com |

http://www.methode.com |

|

|

| |

| • General Corporate Information |

Officers

Jonathan DeGaynor - Chief Executive Officer

Mark D. Schwabero - Chairman

Laura Kowalchik - Chief Financial Officer

Therese M. Bobek - Director

David P. Blom - Director

|

|

Peer Information

Methode Electronics, Inc. (APH)

Methode Electronics, Inc. (TNB)

Methode Electronics, Inc. (MOLX)

Methode Electronics, Inc. (PRLX)

Methode Electronics, Inc. (MEI)

Methode Electronics, Inc. (ESNC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-CONNECTORS

Sector: Computer and Technology

CUSIP: 591520200

SIC: 3678

|

|

Fiscal Year

Fiscal Year End: April

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 35.41

Most Recent Split Date: 11.00 (1.50:1)

Beta: 1.06

Market Capitalization: $299.55 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.36% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.05 |

Indicated Annual Dividend: $0.20 |

| Current Fiscal Year EPS Consensus Estimate: $-0.72 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/16/2026 - $0.05 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |