| Zacks Company Profile for MercadoLibre, Inc. (MELI : NSDQ) |

|

|

| |

| • Company Description |

| MercadoLibre, Inc. is one of the largest e-commerce platforms in Latin America. The company offers a bunch of six integrated e-commerce services:MercadoLibre Marketplace enables businesses and individuals to conduct sales, purchase online and list their merchandise.MercadoLibre Classifieds offers online classified listing services for motor vehicles, real estate and services. These listing charge only optional placement fees and hence they are different from Marketplace listings.MercadoPago FinTech platform allows users to send and receive payments seamlessly within MercadoLibre's marketplace. Outside of this, merchants are allowed to process payments via websites, mobile apps and mobile point of sale.MercadoLibre advertising program enables advertisers and seller to display their product ads on the company's webpages.MercadoShops online webstores solution aids users in managing and promoting their online stores.

Number of Employees: 20,347 |

|

|

| |

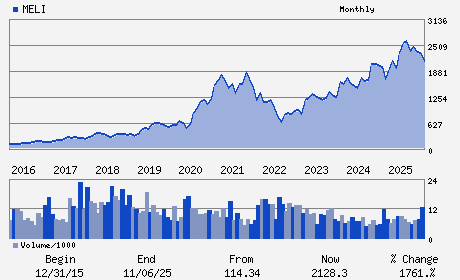

| • Price / Volume Information |

| Yesterday's Closing Price: $1,777.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 672,031 shares |

| Shares Outstanding: 50.70 (millions) |

| Market Capitalization: $90,088.90 (millions) |

| Beta: 1.48 |

| 52 Week High: $2,645.22 |

| 52 Week Low: $1,654.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-17.24% |

-16.10% |

| 12 Week |

-14.91% |

-15.34% |

| Year To Date |

-11.78% |

-12.24% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ariel Szarfsztejn - President and Chief Executive Officer

Marcos Galperin - Executive Chairman

Martin de los Santos - Executive Vice President and Chief Financial Offic

Stelleo Tolda - Director

Susan Segal - Director

|

|

Peer Information

MercadoLibre, Inc. (COOL.)

MercadoLibre, Inc. (GFME)

MercadoLibre, Inc. (GSVI)

MercadoLibre, Inc. (GDENZ)

MercadoLibre, Inc. (EMUS)

MercadoLibre, Inc. (BFLY.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET COMMERCE

Sector: Retail/Wholesale

CUSIP: 58733R102

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 50.70

Most Recent Split Date: (:1)

Beta: 1.48

Market Capitalization: $90,088.90 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $12.07 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $60.15 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 33.72% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |