| Zacks Company Profile for Mistras Group Inc (MG : NYSE) |

|

|

| |

| • Company Description |

| Mistras Group, Inc. is a global provider of technology-enabled, non-destructive testing (NDT) solutions used to evaluate the structural integrity of critical energy, industrial and public infrastructure. The Company delivers a portfolio of solutions, ranging from routine NDT inspections to plant-wide asset integrity assessment and management solutions. The Company serves a global customer base, including companies in the oil and gas, fossil and nuclear power generation and transmission, public infrastructure, chemicals, aerospace and defense, transportation, primary metals and metalworking, pharmaceuticals and food processing industries.

Number of Employees: 4,800 |

|

|

| |

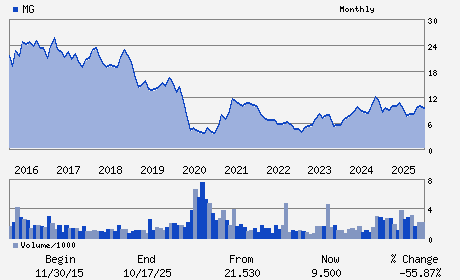

| • Price / Volume Information |

| Yesterday's Closing Price: $15.28 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 125,381 shares |

| Shares Outstanding: 31.55 (millions) |

| Market Capitalization: $482.06 (millions) |

| Beta: 0.86 |

| 52 Week High: $15.53 |

| 52 Week Low: $7.06 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.06% |

9.01% |

| 12 Week |

32.52% |

32.36% |

| Year To Date |

20.79% |

20.20% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

195 CLARKSVILLE ROAD

-

PRINCETON JUNCTION,NJ 08550

USA |

ph: 609-716-4000

fax: 609-716-4145 |

None |

http://www.mistrasgroup.com |

|

|

| |

| • General Corporate Information |

Officers

Natalia Shuman - President and Chief Executive Officer

Manuel N. Stamatakis - Executive Chairman

Hani Hammad - Executive Vice President and Chief Operating Offic

Edward J. Prajzner - Senior Executive Vice President; and Chief Financi

Nicholas DeBenedictis - Director

|

|

Peer Information

Mistras Group Inc (REFR)

Mistras Group Inc (BELFA)

Mistras Group Inc (DIPC)

Mistras Group Inc (V.SSC)

Mistras Group Inc (BNSOF)

Mistras Group Inc (CUB.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC PRODS-MISC

Sector: Computer and Technology

CUSIP: 60649T107

SIC: 8711

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 31.55

Most Recent Split Date: (:1)

Beta: 0.86

Market Capitalization: $482.06 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.10 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.99 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 16.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |