| Zacks Company Profile for Mitsubishi Heavy Industries, Ltd. (MHVYF : OTC) |

|

|

| |

| • Company Description |

| Mitsubishi Heavy Industries, Ltd. engages in the manufacture and sale of ships, industrial machinery and aircrafts. Its operating segments consist of Energy & Environmental; Commercial Aviation & Transportation Systems; Integrated Defense & Space Systems; Machinery Equipment & Infrastructure and Others. Energy & Environmental segment provides solutions in social infrastructure. Commercial Aviation & Transportation Systems segment encompasses land, sea and air transportation systems. Integrated Defense & Space Systems segment provides land, sea, air and space defense systems. Machinery Equipment & Infrastructure segment capitalizes on synergy benefits between business areas applied to a broad lineup of products including machine tools, handling and distribution systems, air-conditioning and refrigeration systems, bridges and others. Others segment offers real estate leasing and sales; printing and information services. Mitsubishi Heavy Industries, Ltd. is headquartered in Tokyo, Japan.

Number of Employees: 77,274 |

|

|

| |

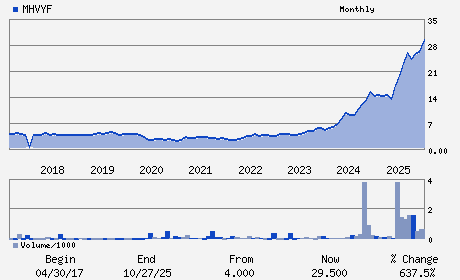

| • Price / Volume Information |

| Yesterday's Closing Price: $31.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 45,180 shares |

| Shares Outstanding: 3,373.65 (millions) |

| Market Capitalization: $107,045.85 (millions) |

| Beta: 0.47 |

| 52 Week High: $34.50 |

| 52 Week Low: $13.36 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.29% |

9.24% |

| 12 Week |

19.74% |

19.59% |

| Year To Date |

28.36% |

27.74% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2-3 Marunouchi 3-chome Chiyoda-ku

-

Tokyo,M0 100-8332

JPN |

ph: 813-6275-6200

fax: 813-6716-5800 |

None |

http://www.mhi.com |

|

|

| |

| • General Corporate Information |

Officers

Seiji Izumisawa - Chief Executive Officer and President

Shunichi Miyanaga - Chairman of the Board

Hisato Kozawa - Chief Financial Officer and Senior Executive Vice

Chibumi Kimura - Senior Vice President

Koji Okura - Director

|

|

Peer Information

Mitsubishi Heavy Industries, Ltd. (B.)

Mitsubishi Heavy Industries, Ltd. (DXPE)

Mitsubishi Heavy Industries, Ltd. (AIT)

Mitsubishi Heavy Industries, Ltd. (GDI.)

Mitsubishi Heavy Industries, Ltd. (CTITQ)

Mitsubishi Heavy Industries, Ltd. (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: J44002178

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/08/26

|

|

Share - Related Items

Shares Outstanding: 3,373.65

Most Recent Split Date: 3.00 (10.00:1)

Beta: 0.47

Market Capitalization: $107,045.85 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.46 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/08/26 |

|

|

|

| |