| Zacks Company Profile for Mitsubishi Estate Co. (MITEY : OTC) |

|

|

| |

| • Company Description |

| Mitsubishi Estate Co., Ltd. is engaged in the development of real estate, including office buildings, residential properties and commercial properties. The Building Business segment is engaged in the development, leasing and property management of office buildings. Its Lifestyle Property segment operates the PREMIUM OUTLETS, MARK IS and other retail facilities. The Residential Business segment provides services, such as development, marketing and leasing. It is engaged in undertaking approximately 30 development projects in over 10 states, including distribution facilities and homes. Its Investment Management segment offers services for both individual and institutional investors. Its Architectural Design and Engineering segment engages in the design and administration of construction and civil engineering projects. Its Hotel Business maintains a network of over eight hotels. Its Real Estate Services segment provides a range of solutions for individuals and corporations.

Number of Employees: 11,412 |

|

|

| |

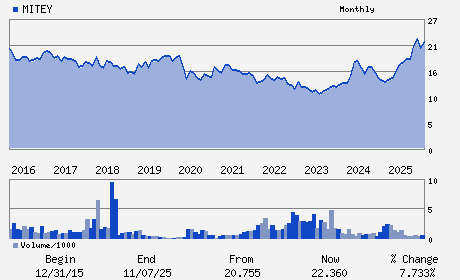

| • Price / Volume Information |

| Yesterday's Closing Price: $32.93 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 67,231 shares |

| Shares Outstanding: 1,217.23 (millions) |

| Market Capitalization: $40,083.50 (millions) |

| Beta: 0.03 |

| 52 Week High: $35.17 |

| 52 Week Low: $14.21 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

29.19% |

30.97% |

| 12 Week |

34.74% |

34.05% |

| Year To Date |

36.02% |

35.30% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Otemachi Building 6-1 Otemachi 1-chome Chiyoda-ku

-

Tokyo,M0 100-8133

JPN |

ph: 813-3287-5100

fax: - |

None |

http://www.mec.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Atsushi Nakajima - Chief Executive Officer and President

Junichi Yoshida - Chairman

Bunroku Naganuma - Executive Vice President

Yutaro Yotsuzuka - Director

Naoki Umeda - Director

|

|

Peer Information

Mitsubishi Estate Co. (AVHI.)

Mitsubishi Estate Co. (HNGKY)

Mitsubishi Estate Co. (INTG)

Mitsubishi Estate Co. (FCAR)

Mitsubishi Estate Co. (AIHC)

Mitsubishi Estate Co. (CDGD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REAL ESTATE DEV

Sector: Finance

CUSIP: 606783207

SIC: 6531

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 1,217.23

Most Recent Split Date: 12.00 (10.00:1)

Beta: 0.03

Market Capitalization: $40,083.50 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.54% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.18 |

| Current Fiscal Year EPS Consensus Estimate: $1.18 |

Payout Ratio: 0.22 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |