| Zacks Company Profile for Marcus & Millichap, Inc. (MMI : NYSE) |

|

|

| |

| • Company Description |

| Marcus & Millichap, Inc. operates a brokerage firm specializing in real estate investments. It offers commercial real estate investment brokerage services for multifamily, retail, office, industrial, land, self-storage, seniors housing, manufactured housing, and mixed-use/other property types. The company also provides a range of advisory and consulting services to developers, lenders, owners, real estate investment trusts, high net worth individuals, pension fund advisors, and other institutions. Marcus & Millichap, Inc. is based in Calabasas, California.

Number of Employees: 897 |

|

|

| |

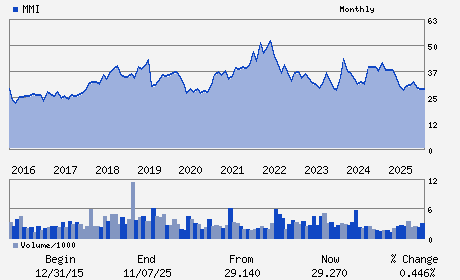

| • Price / Volume Information |

| Yesterday's Closing Price: $26.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 300,161 shares |

| Shares Outstanding: 38.92 (millions) |

| Market Capitalization: $1,027.95 (millions) |

| Beta: 1.32 |

| 52 Week High: $39.59 |

| 52 Week Low: $24.43 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.90% |

-2.06% |

| 12 Week |

-8.71% |

-8.82% |

| Year To Date |

-3.22% |

-3.69% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Hessam Nadji - Director; Presidentand Chief Executive Officer

Steven F. DeGennaro - Chief Financial Officer

Fabrice De Bosschere - First Vice President; Corporate Controller

George M. Marcus - Director

Collete English Dixon - Director

|

|

Peer Information

Marcus & Millichap, Inc. (AVHI.)

Marcus & Millichap, Inc. (HNGKY)

Marcus & Millichap, Inc. (INTG)

Marcus & Millichap, Inc. (FCAR)

Marcus & Millichap, Inc. (AIHC)

Marcus & Millichap, Inc. (CDGD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REAL ESTATE DEV

Sector: Finance

CUSIP: 566324109

SIC: 6531

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 38.92

Most Recent Split Date: (:1)

Beta: 1.32

Market Capitalization: $1,027.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.89% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.50 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 12.50 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 11.15 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |