| Zacks Company Profile for Merck & Co., Inc. (MRK : NYSE) |

|

|

| |

| • Company Description |

| Merck & Co. boasts more than six blockbuster drugs in its portfolio with PD-L1 inhibitor, Keytruda, approved for several types of cancer. Keytruda has played an instrumental role in driving Merck's steady revenue growth in the past few years. Well-known products in Merck's portfolio include Keytruda, Simponi , Januvia and Janumet, Bridion, Isentress, ProQuad, Gardasil, Pneumovax 23, RotaTeq and Belsomra. Merck made its biggest acquisition of Schering-Plough and sold off its Consumer Care business to Bayer. Other key acquisitions include Idenix Pharmaceuticals, Cubist Pharmaceuticals, Rigontec, ArQule and Acceleron Pharma. IMerck spun off products from its Women's Health unit, legacy drugs and biosimilar products into a new publicly traded company called Organon & Co.

Number of Employees: 75,000 |

|

|

| |

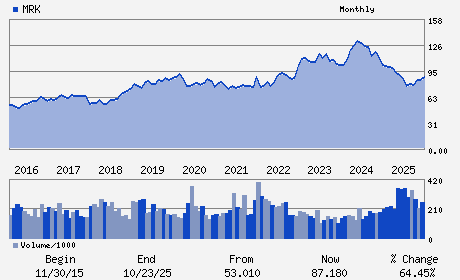

| • Price / Volume Information |

| Yesterday's Closing Price: $121.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 12,605,150 shares |

| Shares Outstanding: 2,472.39 (millions) |

| Market Capitalization: $300,173.09 (millions) |

| Beta: 0.27 |

| 52 Week High: $125.14 |

| 52 Week Low: $73.31 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.09% |

8.57% |

| 12 Week |

22.72% |

22.10% |

| Year To Date |

15.34% |

14.74% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robert M. Davis - Chairman; Chief Executive Officer and President

Caroline Litchfield - Executive Vice President and Chief Financial Offic

Dalton Smart - Senior Vice President

Mary Ellen Coe - Director

Pamela J. Craig - Director

|

|

Peer Information

Merck & Co., Inc. (AGN.)

Merck & Co., Inc. (NVS)

Merck & Co., Inc. (NVO)

Merck & Co., Inc. (LLY)

Merck & Co., Inc. (RHHBY)

Merck & Co., Inc. (JNJ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Large Cap Pharma

Sector: Medical

CUSIP: 58933Y105

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 2,472.39

Most Recent Split Date: 2.00 (2.00:1)

Beta: 0.27

Market Capitalization: $300,173.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.80% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.41 |

Indicated Annual Dividend: $3.40 |

| Current Fiscal Year EPS Consensus Estimate: $5.19 |

Payout Ratio: 0.38 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.23 |

| Estmated Long-Term EPS Growth Rate: 10.04% |

Last Dividend Paid: 12/15/2025 - $0.85 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |