| Zacks Company Profile for Microsoft Corporation (MSFT : NSDQ) |

|

|

| |

| • Company Description |

| Microsoft Corporation is one of the largest broad-based technology providers in the world. The company dominates the PC software market with more than 80% of the market share for operating systems. The company's Microsoft 365 application suite is one of the most popular productivity software globally. It is also now one of the two public cloud providers that can deliver a wide variety of infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) solutions at scale. Microsoft's products include operating systems, cross-device productivity applications, server applications, business solution applications, desktop and server management tools, software development tools and video games. The company designs and sells PCs, tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories. Through Azure, it offers cloud-based solutions that provide customers with software, services, platforms and content.

Number of Employees: 228,000 |

|

|

| |

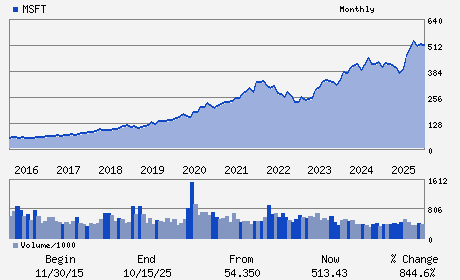

| • Price / Volume Information |

| Yesterday's Closing Price: $392.74 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 40,012,856 shares |

| Shares Outstanding: 7,425.63 (millions) |

| Market Capitalization: $2,916,341.50 (millions) |

| Beta: 1.10 |

| 52 Week High: $555.45 |

| 52 Week Low: $344.79 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.73% |

-7.93% |

| 12 Week |

-18.71% |

-18.82% |

| Year To Date |

-18.79% |

-19.19% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Satya Nadella - Chairman and Chief Executive Officer

Bradford L. Smith - Vice Chair and President

Amy E. Hood - Executive Vice President and Chief Financial Offic

Alice L. Jolla - Corporate Vice President and Chief Accounting Offi

Amy L. Coleman - Executive Vice President and Chief Human Resources

|

|

Peer Information

Microsoft Corporation (ATEA)

Microsoft Corporation (BITS.)

Microsoft Corporation (DCTM)

Microsoft Corporation (DLVAZ)

Microsoft Corporation (DOCC)

Microsoft Corporation (NEON)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-SOFTWARE

Sector: Computer and Technology

CUSIP: 594918104

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 7,425.63

Most Recent Split Date: 2.00 (2.00:1)

Beta: 1.10

Market Capitalization: $2,916,341.50 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.93% |

| Current Fiscal Quarter EPS Consensus Estimate: $4.05 |

Indicated Annual Dividend: $3.64 |

| Current Fiscal Year EPS Consensus Estimate: $16.37 |

Payout Ratio: 0.24 |

| Number of Estimates in the Fiscal Year Consensus: 13.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 15.61% |

Last Dividend Paid: 02/19/2026 - $0.91 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |