| Zacks Company Profile for Mitsubishi Chemical Holdings Corp. (MTLHY : OTC) |

|

|

| |

| • Company Description |

| Mitsubishi Chemical Holdings Corporation engages in the production and sale of various chemical, healthcare, and performance products primarily in Japan. The company's Electronics Applications segment offers optical recording media, display materials, and polyester films. Its Designed Materials segment engages in the business related to aluminum composite materials, sales of construction and industrial materials, plastic shrinkable labels for PET bottles and heat shrinkable tubes. The company's Health Care segment is involved in businesses related to chemicals and related products, manufacture and sale of pharmaceuticals, clinical testing and diagnostics. Its Chemicals segment engages in the businesses of industrial and specialty chemicals, nonionic surfactants, glycol ethers, and fine chemicals. The company's Polymers segment's businesses comprise activities in the areas of PET, polyethylene, and nylon resins for automotive industry. Mitsubishi Chemical Holdings Corporation is headquartered in Tokyo, Japan.

Number of Employees: 63,258 |

|

|

| |

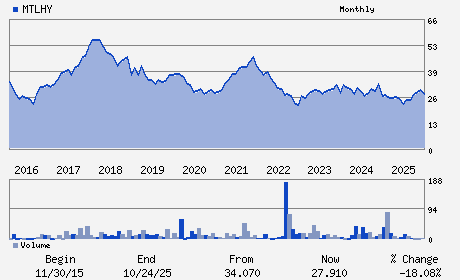

| • Price / Volume Information |

| Yesterday's Closing Price: $35.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 226 shares |

| Shares Outstanding: 288.29 (millions) |

| Market Capitalization: $10,248.83 (millions) |

| Beta: 0.62 |

| 52 Week High: $38.74 |

| 52 Week Low: $19.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.62% |

13.15% |

| 12 Week |

33.77% |

33.09% |

| Year To Date |

20.92% |

20.28% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1-1 Marunochi 1-chome Chiyoda-ku

-

Tokyo,M0 100-8251

JPN |

ph: 81 03 6748 7140

fax: - |

None |

http://www.mcgc.com |

|

|

| |

| • General Corporate Information |

Officers

Jean-Marc Gilson - Chief Executive Officer and President

Yoshimitsu Kobayashi - Chairman

Yuko Nakahira - Executive Vice President and Chief Financial Offic

Glenn H. Fredrickson - Director

Hisao Urata - Director

|

|

Peer Information

Mitsubishi Chemical Holdings Corp. (ENFY)

Mitsubishi Chemical Holdings Corp. (EMLIF)

Mitsubishi Chemical Holdings Corp. (GPLB)

Mitsubishi Chemical Holdings Corp. (BCPUQ)

Mitsubishi Chemical Holdings Corp. (CYT.)

Mitsubishi Chemical Holdings Corp. (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 606763100

SIC: 2011

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 06/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 288.29

Most Recent Split Date: (:1)

Beta: 0.62

Market Capitalization: $10,248.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.95% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.69 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |