| Zacks Company Profile for MACOM Technology Solutions Holdings, Inc. (MTSI : NSDQ) |

|

|

| |

| • Company Description |

| MACOM Technology Solutions Holdings, Inc., being a provider of power analog semiconductor solutions to varied markets, develops and produces analog radio frequency (RF), microwave and millimeter wave semiconductor devices, and components for applications in optical, wireless and satellite networks. It primarily serves three markets, namely, data center, industrial & defense and telecom. Data Center market demands for complete chip-set solutions. MACOM offers modulator drivers, lasers, silicon photonics and many more in this market. Industrial and Defense market requires military and commercial radar, RF jammers, electronic countermeasures and communication data links. Telecom market leverages the power of the company's opto-electronic products such as optical post amplifiers, laser clock, modulator drivers, transmitter and receiver applications. MACOM competes with both customers' internal design resources as well as other high-performance analog semiconductor suppliers.

Number of Employees: 2,000 |

|

|

| |

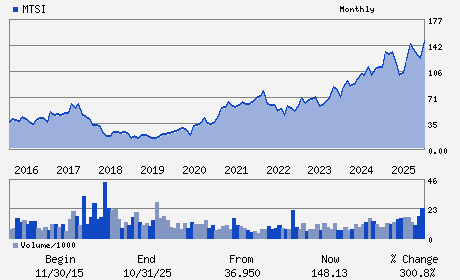

| • Price / Volume Information |

| Yesterday's Closing Price: $248.12 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,333,008 shares |

| Shares Outstanding: 75.01 (millions) |

| Market Capitalization: $18,611.97 (millions) |

| Beta: 1.41 |

| 52 Week High: $256.12 |

| 52 Week Low: $84.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

13.27% |

14.26% |

| 12 Week |

34.78% |

34.61% |

| Year To Date |

44.86% |

44.16% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

100 CHELMSFORD STREET

-

LOWELL,MA 01851

USA |

ph: 978-656-2500

fax: 978-656-2804 |

ir@macomtech.com |

http://www.macom.com |

|

|

| |

| • General Corporate Information |

Officers

Stephen G. Daly - President and Chief Executive Officer and Chairman

John F. Kober - Senior Vice President and Chief Financial Officer

Peter Chung - Director

Charles Bland - Director

Geoffrey Ribar - Director

|

|

Peer Information

MACOM Technology Solutions Holdings, Inc. (ADI)

MACOM Technology Solutions Holdings, Inc. (MXL)

MACOM Technology Solutions Holdings, Inc. (SMTC)

MACOM Technology Solutions Holdings, Inc. (SLAB)

MACOM Technology Solutions Holdings, Inc. (MCHP)

MACOM Technology Solutions Holdings, Inc. (MCRL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SEMI-ANALOG & MIXED

Sector: Computer and Technology

CUSIP: 55405Y100

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 75.01

Most Recent Split Date: (:1)

Beta: 1.41

Market Capitalization: $18,611.97 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.76 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.18 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 16.38% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |