| Zacks Company Profile for Murphy Oil Corporation (MUR : NYSE) |

|

|

| |

| • Company Description |

| Murphy Oil Corporation is a global oil and gas exploration and production company. The company explores and produces crude oil, natural gas and natural gas liquids (NGL) worldwide. Previously, it had refining and marketing operations in both the U.S. and the UK.? The company is currently transforming itself into an organization primarily engaged in oil and gas exploration and production (E&P) activities from an integrated oil company. For reporting purposes, Murphy Oil's exploration and production activities were subdivided into four geographic segments that include the United States, Canada and all other countries. Some of the important fields in which Murphy operates or has a working interest are as follows: the Eagle Ford Shale and the Gulf of Mexico (GoM) in the U.S., Hibernia, Terra Nova, Kaybob Duvernay and Placid Montney in Canada and Ceduna, Browse, Carnarvon and Perth in Australia. In addition, the company has a presence in Brunei, Equatorial Guinea, Indonesia, Namibia and Vietnam.

Number of Employees: 813 |

|

|

| |

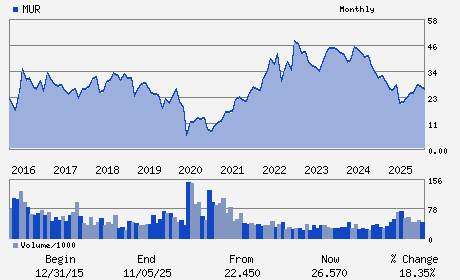

| • Price / Volume Information |

| Yesterday's Closing Price: $34.82 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,839,087 shares |

| Shares Outstanding: 142.83 (millions) |

| Market Capitalization: $4,973.35 (millions) |

| Beta: 0.72 |

| 52 Week High: $35.50 |

| 52 Week Low: $18.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

17.59% |

19.22% |

| 12 Week |

7.50% |

6.95% |

| Year To Date |

11.42% |

10.84% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Eric M. Hambly - Chief Executive Officer; President and Director

Claiborne P. Deming - Chairman and Director

Thomas J. Mireles - Executive Vice President and Chief Financial Off

Paul D. Vaughan - Vice President and Controller

Jeffrey W. Nolan - Director

|

|

Peer Information

Murphy Oil Corporation (AEGG)

Murphy Oil Corporation (CHAR)

Murphy Oil Corporation (CECX.)

Murphy Oil Corporation (DLOV)

Murphy Oil Corporation (WACC)

Murphy Oil Corporation (DVN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US EXP&PROD

Sector: Oils/Energy

CUSIP: 626717102

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 142.83

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.72

Market Capitalization: $4,973.35 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.02% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.02 |

Indicated Annual Dividend: $1.40 |

| Current Fiscal Year EPS Consensus Estimate: $0.38 |

Payout Ratio: 0.94 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.50 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/17/2026 - $0.35 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |