| Zacks Company Profile for Myomo, Inc. (MYO : AMEX) |

|

|

| |

| • Company Description |

| Myomo, Inc. is a commercial stage medical robotics company. It offers expanded mobility which suffering from neurological disorders and upper limb paralysis. The company develops and markets the MyoPro(R) product line of lightweight, non-invasive, powered arm braces to restore function in the paralyzed or weakened arms and hands of individuals. Myomo, Inc. is headquartered in Cambridge,Massachusetts.

Number of Employees: 185 |

|

|

| |

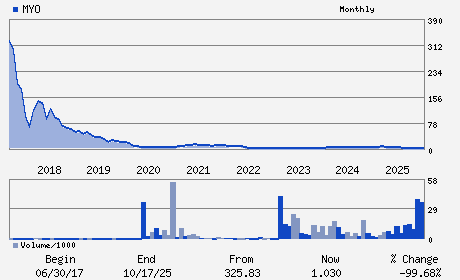

| • Price / Volume Information |

| Yesterday's Closing Price: $0.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 382,532 shares |

| Shares Outstanding: 38.44 (millions) |

| Market Capitalization: $29.79 (millions) |

| Beta: 1.17 |

| 52 Week High: $6.30 |

| 52 Week Low: $0.64 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.64% |

-6.83% |

| 12 Week |

-25.48% |

-25.57% |

| Year To Date |

-14.84% |

-15.25% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

45 Blue Sky Dr. Suite 101

-

Burlington,MA 01803

USA |

ph: 617-996-9058

fax: - |

ir@myomo.com |

http://www.myomo.com |

|

|

| |

| • General Corporate Information |

Officers

Paul R. Gudonis - Chief Executive Officer and Chairman

David A. Henry - Chief Financial Officer

Amy Knapp - Director

Thomas A. Crowley, Jr. - Director

Thomas F. Kirk - Director

|

|

Peer Information

Myomo, Inc. (BJCT)

Myomo, Inc. (CADMQ)

Myomo, Inc. (APNO)

Myomo, Inc. (UPDC)

Myomo, Inc. (IMTIQ)

Myomo, Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 62857J201

SIC: 3842

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/09/26

|

|

Share - Related Items

Shares Outstanding: 38.44

Most Recent Split Date: 1.00 (0.03:1)

Beta: 1.17

Market Capitalization: $29.79 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.09 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.29 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/09/26 |

|

|

|

| |