| Zacks Company Profile for Mazda Motor Corporation (MZDAY : OTC) |

|

|

| |

| • Company Description |

| Mazda Motor Corp. engages in the manufacture and sale of passenger cars, commercial vehicles and automotive parts. It products include trucks, engines, transmission parts, machine tools and materials for casting. The company operates primarily in Japan, North America, Europe and Other Areas. Mazda Motor Corp. is headquartered in Aki-gun, Japan.

Number of Employees: 48,783 |

|

|

| |

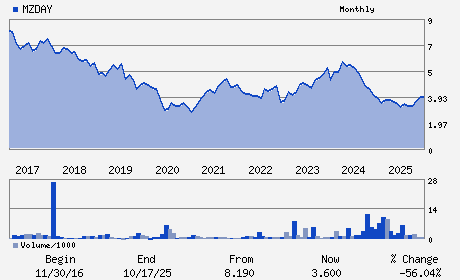

| • Price / Volume Information |

| Yesterday's Closing Price: $4.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 35,675 shares |

| Shares Outstanding: 1,260.70 (millions) |

| Market Capitalization: $5,521.87 (millions) |

| Beta: 0.45 |

| 52 Week High: $4.55 |

| 52 Week Low: $2.58 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.26% |

16.27% |

| 12 Week |

22.69% |

22.54% |

| Year To Date |

13.77% |

13.21% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3-1Shinchi Fuchu-cho Aki-gun

-

Hiroshima,M0 730-8670

JPN |

ph: 818-2282-1111

fax: - |

None |

http://www.mazda.com |

|

|

| |

| • General Corporate Information |

Officers

Masahiro Moro - President and Chief Executive Officer

Kiyotaka Shobuda - Chairman

Jeffrey H. Guyton - Managing Executive Officer and Chief Financial Off

Kiyoshi Sato - Director

Michiko Ogawa - Director

|

|

Peer Information

Mazda Motor Corporation (DIN.L)

Mazda Motor Corporation (SSM)

Mazda Motor Corporation (FIATY)

Mazda Motor Corporation (FUJHY)

Mazda Motor Corporation (BAMXF)

Mazda Motor Corporation (BRDCY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO -FOREIGN

Sector: Auto/Tires/Trucks

CUSIP: 578787103

SIC: 3711

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 1,260.70

Most Recent Split Date: (:1)

Beta: 0.45

Market Capitalization: $5,521.87 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.47% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.11 |

| Current Fiscal Year EPS Consensus Estimate: $0.10 |

Payout Ratio: 0.29 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.16 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |