| Zacks Company Profile for Nabors Industries Ltd. (NBR : NYSE) |

|

|

| |

| • Company Description |

| Nabors Industries Ltd. is one of the largest land-drilling contractors in the world, conducting oil, gas, and geothermal land drilling operations across countries. It has a ownership in Saudi Arabia named Nabors Arabia. It offers a number of ancillary wellsite services, including oilfield management, engineering, transportation, construction, maintenance, well logging, and other support services in select domestic and international markets. Nabors has 4 major segments: U.S. Drilling, International Drilling, Drilling Solutions & Rig Technologies. US Drilling comprises drilling activities in the Lower 48 and Alaska along with offshore activities in Gulf of Mexico. International Drilling has operations in almost every major energy-producing sites in the world. Drilling Solutions segment engages in providing specialized technology that optimizes drilling performance and wellbore placement. Rig Technologies segment deals in manufacturing drilling related equipment and also provides aftermarket sales & services.

Number of Employees: 13,900 |

|

|

| |

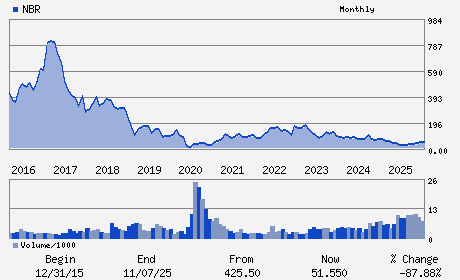

| • Price / Volume Information |

| Yesterday's Closing Price: $76.90 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 431,894 shares |

| Shares Outstanding: 14.67 (millions) |

| Market Capitalization: $1,128.37 (millions) |

| Beta: 0.89 |

| 52 Week High: $82.30 |

| 52 Week Low: $23.27 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

16.29% |

17.89% |

| 12 Week |

39.59% |

38.88% |

| Year To Date |

41.62% |

40.88% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Anthony G. Petrello - Chief Executive Officer; Chairman and President

Miguel Rodriguez - Chief Financial Officer

Tanya S. Beder - Director

Anthony R. Chase - Director

James R. Crane - Director

|

|

Peer Information

Nabors Industries Ltd. (DOFSQ)

Nabors Industries Ltd. (NBR)

Nabors Industries Ltd. (OKOK)

Nabors Industries Ltd. (PMESY)

Nabors Industries Ltd. (GW)

Nabors Industries Ltd. (GLM)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL&GAS-DRILL

Sector: Oils/Energy

CUSIP: G6359F137

SIC: 1381

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 14.67

Most Recent Split Date: 4.00 (0.02:1)

Beta: 0.89

Market Capitalization: $1,128.37 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-2.35 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-6.28 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |