| Zacks Company Profile for Nitto Denko Corp. (NDEKY : OTC) |

|

|

| |

| • Company Description |

| Nitto Denko Corporation is a provider of electrical insulating materials such as double-coated tapes, sealing materials, masking tapes, surface protection materials and non-skid tapes in diverse segments of industry. Its products are designed to assure safety in offices and buildings, precision machinery, machinery & equipment used in production process, and actual work sites. The Company's technologies and products include reinforcing, vibration-damping and sealing materials. It supplies a whole variety of adhesive tapes in medical and athletic areas. Nitto Denko Group has an extensive lineup of electronics-related products such as optical films, flexible printed circuits, thin-film metal circuit boards and semiconductor encapsulating resins which are applied to various devices including wide-screen LCD TVs, personal computers, cell phones, handheld game consoles, portable audio players, hard disk drives and so on. Nitto Denko Corporation is headquartered in Osaka, Japan.

Number of Employees: 27,915 |

|

|

| |

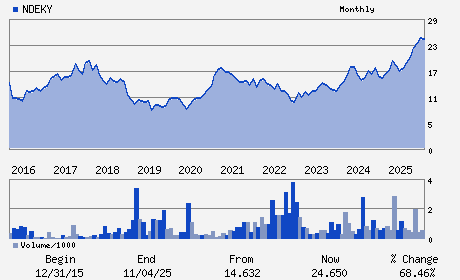

| • Price / Volume Information |

| Yesterday's Closing Price: $21.34 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 45,803 shares |

| Shares Outstanding: 678.66 (millions) |

| Market Capitalization: $14,482.60 (millions) |

| Beta: 0.88 |

| 52 Week High: $26.48 |

| 52 Week Low: $15.73 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.13% |

-1.69% |

| 12 Week |

-13.00% |

-12.70% |

| Year To Date |

-10.16% |

-9.78% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

33rd Floor 4-20 Ofuka-cho Kita-ku

-

Osaka,M0 530-0011

JPN |

ph: 816-7632-2101

fax: 816-7632-2102 |

None |

http://www.nitto.com |

|

|

| |

| • General Corporate Information |

Officers

Hideo Takasaki - Chief Executive Officer; Chief operating Officer a

Yasuhiro Iseyama - Senior Executive Vice President; CFO and Accountin

Yosuke Miki - Senior Executive Vice President

Tatsuya Akagi - Executive Vice President

Wong Lai Yong - Director

|

|

Peer Information

Nitto Denko Corp. (DSPG)

Nitto Denko Corp. (ASMIY)

Nitto Denko Corp. (PMCS)

Nitto Denko Corp. (TQNT)

Nitto Denko Corp. (BRCM)

Nitto Denko Corp. (SLAMF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Semi-Communications

Sector: Computer and Technology

CUSIP: 654802206

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 678.66

Most Recent Split Date: 10.00 (2.50:1)

Beta: 0.88

Market Capitalization: $14,482.60 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.07% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.23 |

| Current Fiscal Year EPS Consensus Estimate: $1.30 |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.06 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |