| Zacks Company Profile for NeoGenomics, Inc. (NEO : NSDQ) |

|

|

| |

| • Company Description |

| NeoGenomics, Inc. is a high-complexity CLIA-certified clinical laboratory that specializes in cancer genetics diagnostic testing, the fastest growing segment of the laboratory industry. The company's testing services include cytogenetics, fluorescence in-situ hybridization, flow cytometry, morphology studies, anatomic pathology and molecular genetic testing. Headquartered in Fort Myers, FL, NeoGenomics has labs in Nashville, TN, Irvine, CA and Fort Myers and services the needs of pathologists, oncologists, urologists, hospitals and other reference laboratories throughout the United States.

Number of Employees: 2,500 |

|

|

| |

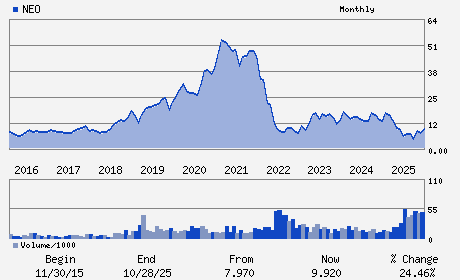

| • Price / Volume Information |

| Yesterday's Closing Price: $9.83 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,874,183 shares |

| Shares Outstanding: 129.81 (millions) |

| Market Capitalization: $1,276.05 (millions) |

| Beta: 1.62 |

| 52 Week High: $13.74 |

| 52 Week Low: $4.72 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-18.49% |

-17.78% |

| 12 Week |

-17.40% |

-17.50% |

| Year To Date |

-16.41% |

-16.82% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Anthony P. Zook - Chief Executive Officer and Director

Lynn A. Tetrault - Chair of the Board

Jeffrey S. Sherman - Chief Financial Officer

Greg D. Aunan - Senior Vice President & Chief Accounting Officer

Marjorie C. Green - Director

|

|

Peer Information

NeoGenomics, Inc. (CORR.)

NeoGenomics, Inc. (RSPI)

NeoGenomics, Inc. (CGXP)

NeoGenomics, Inc. (BGEN)

NeoGenomics, Inc. (GTBP)

NeoGenomics, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 64049M209

SIC: 8734

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 129.81

Most Recent Split Date: (:1)

Beta: 1.62

Market Capitalization: $1,276.05 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.08 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.16 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 31.04% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |