| Zacks Company Profile for Neogen Corporation (NEOG : NSDQ) |

|

|

| |

| • Company Description |

| Neogen Corp. develops and markets food and animal safety products. Its Food Safety Division markets culture media and diagnostic test kits to detect foodborne bacteria, natural toxins, food allergens, drug residues, plant diseases and sanitation concerns. Neogen has 2 business segments: Food Safety and Animal Safety. Food Safety: The products in the segment include tests for Mycotoxins, Food allergens, Dairy antibiotics, Foodborne pathogens, Spoilage microorganisms, Sanitation monitoring, Dehydrated culture media and Seafood contaminants. Animal Safety: The division is engaged in the development, manufacture, marketing and distribution of veterinary instruments, pharmaceuticals, vaccines, topicals, diagnostic products, rodenticides, cleaners, disinfectants, insecticides and genomics testing services for the worldwide animal safety market. These products are marketed via national & international distributors and farm supply retail chains in the U.S. and Canada. It acquired Delta Genomics Centre in Canada.

Number of Employees: 975 |

|

|

| |

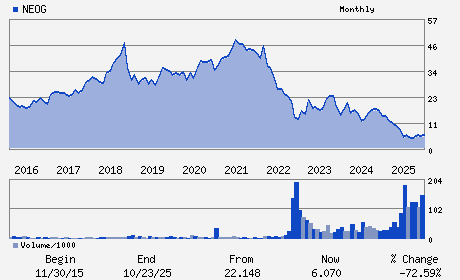

| • Price / Volume Information |

| Yesterday's Closing Price: $10.80 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,981,750 shares |

| Shares Outstanding: 217.53 (millions) |

| Market Capitalization: $2,349.28 (millions) |

| Beta: 1.95 |

| 52 Week High: $11.43 |

| 52 Week Low: $3.87 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.47% |

2.66% |

| 12 Week |

54.73% |

55.12% |

| Year To Date |

54.51% |

53.97% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

620 LESHER PLACE

-

LANSING,MI 48912

USA |

ph: 517-372-9200

fax: 517-372-2006 |

ir@neogen.com |

http://www.neogen.com |

|

|

| |

| • General Corporate Information |

Officers

John E. Adent - Chief Executive Officer and President

James C. Borel - Chairman

David H. Naemura - Chief Financial & Operating Officer

Thierry Bernard - Director

William T. Boehm - Director

|

|

Peer Information

Neogen Corporation (BJCT)

Neogen Corporation (CADMQ)

Neogen Corporation (APNO)

Neogen Corporation (UPDC)

Neogen Corporation (IMTIQ)

Neogen Corporation (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 640491106

SIC: 2835

|

|

Fiscal Year

Fiscal Year End: May

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 04/08/26

|

|

Share - Related Items

Shares Outstanding: 217.53

Most Recent Split Date: 6.00 (2.00:1)

Beta: 1.95

Market Capitalization: $2,349.28 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.06 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.23 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/08/26 |

|

|

|

| |