| Zacks Company Profile for Anglo American (NGLOY : OTC) |

|

|

| |

| • Company Description |

| Anglo American PLC is a mining company. Its portfolio includes iron ore, manganese, metallurgical coal, copper, nickel, platinum and diamonds. The company operates primarily in Africa, Europe, North and South America, Asia and Australia. Anglo American PLC is headquartered in London, the United Kingdom.

Number of Employees: 55,542 |

|

|

| |

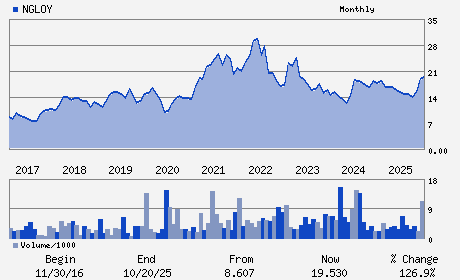

| • Price / Volume Information |

| Yesterday's Closing Price: $25.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 383,129 shares |

| Shares Outstanding: 2,356.10 (millions) |

| Market Capitalization: $58,902.52 (millions) |

| Beta: 0.86 |

| 52 Week High: $26.04 |

| 52 Week Low: $12.69 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.53% |

8.47% |

| 12 Week |

25.75% |

25.60% |

| Year To Date |

20.83% |

20.25% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Duncan Wanblad - Chief Executive Officer

Stuart Chambers - Chairman

John Heasley - Finance Director

Magali Anderson - Director

Hilary Maxson - Director

|

|

Peer Information

Anglo American (DMM.)

Anglo American (HNDNF)

Anglo American (ANUC)

Anglo American (CAU)

Anglo American (ENVG.)

Anglo American (EMEX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -MISC

Sector: Basic Materials

CUSIP: 03485P409

SIC: 1000

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 2,356.10

Most Recent Split Date: 6.00 (0.88:1)

Beta: 0.86

Market Capitalization: $58,902.52 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.22% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.06 |

| Current Fiscal Year EPS Consensus Estimate: $0.84 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 43.28% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |