| Zacks Company Profile for Nidec Corp. (NJDCY : OTC) |

|

|

| |

| • Company Description |

| Nidec Corp and its subsidiaries are primarily engaged in the design, development, manufacturing and marketing of i) small precision motors, ii) mid-size motors, iii) machinery and power supplies, and iv) other products, which include auto parts, pivot assemblies, encoders and other services. Manufacturing operations are located primarily in Asia and they have sales subsidiaries in Asia, North America and Europe.

Number of Employees: |

|

|

| |

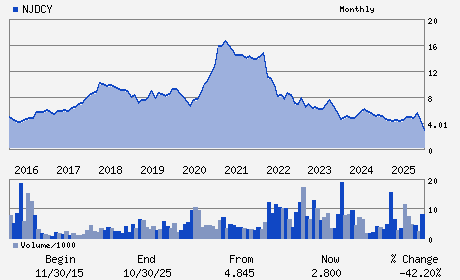

| • Price / Volume Information |

| Yesterday's Closing Price: $3.64 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 25,442 shares |

| Shares Outstanding: 9,540.55 (millions) |

| Market Capitalization: $34,727.61 (millions) |

| Beta: 0.96 |

| 52 Week High: $5.70 |

| 52 Week Low: $1.90 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.82% |

4.24% |

| 12 Week |

11.66% |

11.09% |

| Year To Date |

9.64% |

9.06% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

38 KUZETONOSHIRO-CHO

-

KYOTO,M0 601-8205

JPN |

ph: 817-5935-6140

fax: 817-5935-6101 |

ir@nidec.com |

http://www.nidec.com |

|

|

| |

| • General Corporate Information |

Officers

Shigenobu Nagamori - Chief Executive Officer;Chairman; President

Hiroshi Kobe - President and Chief Operating Officer

ToshihikoKoseki - Executive Vice President

Michael Briggs - Senior Vice President

TakahiroSato - Vice President

|

|

Peer Information

Nidec Corp. (SMTI.)

Nidec Corp. (DDICQ)

Nidec Corp. (CGGIQ)

Nidec Corp. (CRDN)

Nidec Corp. (CDTS)

Nidec Corp. (AURAQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MISC COMPONENTS

Sector: Computer and Technology

CUSIP: 654090109

SIC: 3621

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 9,540.55

Most Recent Split Date: 10.00 (2.00:1)

Beta: 0.96

Market Capitalization: $34,727.61 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.65% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.02 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.18 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.05 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |