| Zacks Company Profile for National Bankshares, Inc. (NKSH : NSDQ) |

|

|

| |

| • Company Description |

| National Bankshares, Inc. is a bank holding company. Except for a separate investment portfolio, Bankshares conducts all of its business operations through its two wholly-owned subsidiaries, The National Bank of Blacksburg and Bank of Tazewell County .

Number of Employees: 245 |

|

|

| |

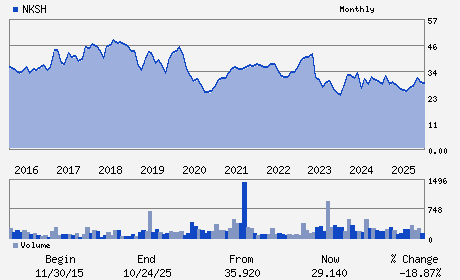

| • Price / Volume Information |

| Yesterday's Closing Price: $37.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 14,775 shares |

| Shares Outstanding: 6.37 (millions) |

| Market Capitalization: $240.57 (millions) |

| Beta: 0.70 |

| 52 Week High: $40.00 |

| 52 Week Low: $23.75 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.15% |

2.54% |

| 12 Week |

23.70% |

23.07% |

| Year To Date |

12.70% |

12.11% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

F. Brad Denardo - Chairman and CEO

Lara E. Ramsey - President; Corporate Secretary

Lora M. Jones - Treasurer and CFO

Norman V. Fitzwater, III - Director

Charles. E. Green, III - Director

|

|

Peer Information

National Bankshares, Inc. (TSFG)

National Bankshares, Inc. (ABCB)

National Bankshares, Inc. (CFNL)

National Bankshares, Inc. (CPKF)

National Bankshares, Inc. (HIB)

National Bankshares, Inc. (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 634865109

SIC: 6021

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 6.37

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.70

Market Capitalization: $240.57 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.13% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.65 |

Indicated Annual Dividend: $1.56 |

| Current Fiscal Year EPS Consensus Estimate: $2.82 |

Payout Ratio: 0.60 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.22 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |