| Zacks Company Profile for ServiceNow, Inc. (NOW : NYSE) |

|

|

| |

| • Company Description |

| ServiceNow Inc. provides cloud computing services that automate digital workflows to accelerate enterprise IT operations. The company's Now Platform enables enterprises to enhance productivity by streamlining system processes. By utilizing its product portfolio, customers can reduce the manual time taken by complex processes and consequently optimize total cost of ownership. Its solutions address the needs of many departments within an enterprise, including IT, HR, facilities, field service, marketing, customer service, security, legal & finance. The company has 3 product suites for IT management and operations: IT Service Management, IT Operations Management and IT Business Management solutions. Non-IT products include Customer Service, HR and Security Operations. Its end-markets include financial services, consumer products, IT services, health care, government, education and technology. ServiceNow derives revenues from two sources: subscriptions and professional services & others.

Number of Employees: 29,187 |

|

|

| |

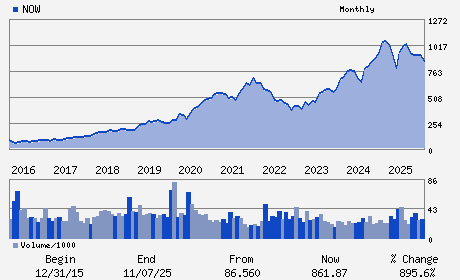

| • Price / Volume Information |

| Yesterday's Closing Price: $108.01 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 23,025,582 shares |

| Shares Outstanding: 1,046.00 (millions) |

| Market Capitalization: $112,978.46 (millions) |

| Beta: 0.99 |

| 52 Week High: $211.48 |

| 52 Week Low: $98.77 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.69% |

-6.88% |

| 12 Week |

-36.79% |

-36.87% |

| Year To Date |

-29.49% |

-29.83% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

William R. McDermott - Chairman and Chief Executive Officer

Gina Mastantuono - President and Chief Financial Officer

Kevin T. McBride - Chief Accounting Officer

Frederic B. Luddy - Director

Susan L. Bostrom - Director

|

|

Peer Information

ServiceNow, Inc. (UIS)

ServiceNow, Inc. (CTSH)

ServiceNow, Inc. (ASGN)

ServiceNow, Inc. (GTTNQ)

ServiceNow, Inc. (DXC)

ServiceNow, Inc. (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: 81762P102

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 1,046.00

Most Recent Split Date: 12.00 (5.00:1)

Beta: 0.99

Market Capitalization: $112,978.46 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.54 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.48 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 17.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 23.94% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |