| Zacks Company Profile for Nippon Yusen Kabushiki Kaisha (NPNYY : OTC) |

|

|

| |

| • Company Description |

| Nippon Yusen Kabushiki Kaisha is a logistics enterprise, providing ocean, land, and air transportation services. Its main activities include global logistics based on international marine transportation business, cruises, terminal and harbor transport, shipping-related services and real estate. Its global logistics business offers global logistics service, centering on marine transportation, container transport, car transport, logistics and terminal & harbor transport services. Its bulk or energy transport business engages in transportation of raw materials and energy resources in response to cargo characteristics and demand. Its cruise ship service is provided by two NYK group companies. Its technology development segment includes introduction to air cargo business and research and development business for transportation systems. Nippon Yusen Kabushiki Kaisha is headquartered in Tokyo, Japan.

Number of Employees: 35,230 |

|

|

| |

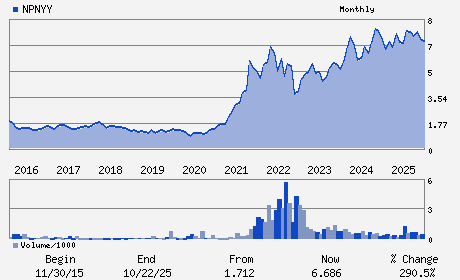

| • Price / Volume Information |

| Yesterday's Closing Price: $6.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 66,406 shares |

| Shares Outstanding: 2,170.51 (millions) |

| Market Capitalization: $15,171.85 (millions) |

| Beta: 1.08 |

| 52 Week High: $7.62 |

| 52 Week Low: $5.68 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.48% |

6.04% |

| 12 Week |

13.84% |

14.24% |

| Year To Date |

9.22% |

9.68% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2-3-2 MARUNOUCHI 2-CHOME CHIYODA-KU

-

TOKYO,M0 100-0005

JPN |

ph: 011-813-3284-5151

fax: - |

None |

http://www.nyk.com |

|

|

| |

| • General Corporate Information |

Officers

Takaya Soga - President; CEO; Group CEO & Representative Directo

Yasushi Yamamoto - Executive Officer & GM of Technical Group

Yasuyuki Takahashi - Group Chief Information Officer & Chief Informatio

Yasuaki Okada - General Manager of IR Group

Nobuhiro Kashima - Senior Managing Executive Officer & Chief Executiv

|

|

Peer Information

Nippon Yusen Kabushiki Kaisha (BHODQ)

Nippon Yusen Kabushiki Kaisha (GNK.2)

Nippon Yusen Kabushiki Kaisha (NPTOY)

Nippon Yusen Kabushiki Kaisha (SCRB)

Nippon Yusen Kabushiki Kaisha (SHWK)

Nippon Yusen Kabushiki Kaisha (ACLNF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SHIP

Sector: Transportation

CUSIP: 654633304

SIC: 4412

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 2,170.51

Most Recent Split Date: 10.00 (3.00:1)

Beta: 1.08

Market Capitalization: $15,171.85 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.79% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.19 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.30 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.08 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |