| Zacks Company Profile for Natera, Inc. (NTRA : NSDQ) |

|

|

| |

| • Company Description |

| Natera, Inc. offers genetic testing and diagnostics with proprietary bioinformatics and molecular technology. Natera, Inc. is headquartered in San Carlos, California.

Number of Employees: 4,434 |

|

|

| |

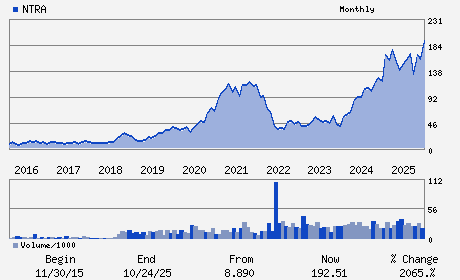

| • Price / Volume Information |

| Yesterday's Closing Price: $200.17 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,162,477 shares |

| Shares Outstanding: 141.73 (millions) |

| Market Capitalization: $28,370.34 (millions) |

| Beta: 1.65 |

| 52 Week High: $256.36 |

| 52 Week Low: $125.38 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.38% |

-12.19% |

| 12 Week |

-16.30% |

-16.72% |

| Year To Date |

-12.62% |

-13.08% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

13011 McCallen Pass Building A Suite 100

-

Austin,TX 78753

USA |

ph: 650-980-9190

fax: - |

investor@natera.com |

http://www.natera.com |

|

|

| |

| • General Corporate Information |

Officers

Steve Chapman - Chief Executive Officer and President

Matthew Rabinowitz - Executive Chairman

Michael Brophy - Chief Financial Officer

Roy Baynes - Director

Monica Bertagnolli - Director

|

|

Peer Information

Natera, Inc. (CHCR)

Natera, Inc. (ESRX)

Natera, Inc. (MYDP)

Natera, Inc. (COR)

Natera, Inc. (GBCS)

Natera, Inc. (LAXAF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Medical Services

Sector: Medical

CUSIP: 632307104

SIC: 8071

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 141.73

Most Recent Split Date: (:1)

Beta: 1.65

Market Capitalization: $28,370.34 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.52 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.66 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |